25 Best Practices That Can Lower Health Benefit Cost

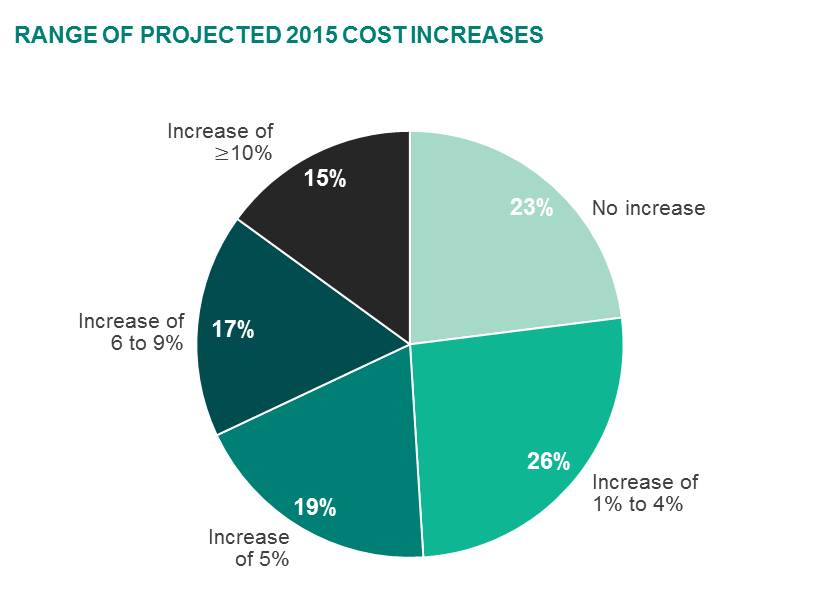

A couple of weeks ago we reported preliminary findings from our latest National Survey of Employer-Sponsored Health Plans showing that employers predict an average increase of 3.9% in total health benefit cost per employee. If their prediction is accurate, it will mean a fourth year of cost growth under 5%.*

It’s important to note that the 3.9% projection takes into account the changes employers will make to hold down cost growth. If they made no changes, cost would rise an estimated 5.8%. It’s also important to remember that 3.9% is only an average, and that some employers — 23% — expect to see no increase in per-employee cost at all, while 15% are bracing for increases of 10% or more.

How to explain this variation? A number of factors that can affect health plan experience from one year to the next, such as high-cost claims, changes in the employee population due to a merger or acquisition, or changes in the provider network, are beyond an employer’s control. Fully insured employers are vulnerable to carrier rate hikes, especially in markets with limited competition. But our research shows that the steps an employer takes — or doesn’t take — to manage cost over time have a significant impact on their health plan cost and cost growth.

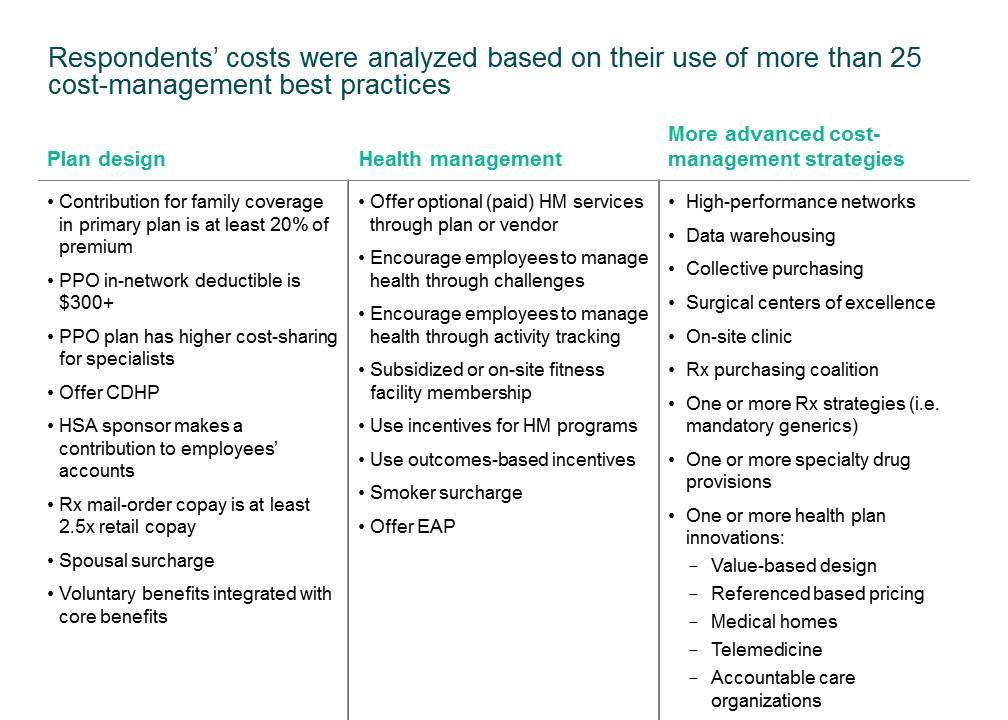

For a third year, we analyzed survey results to see to what extent health plan cost is affected by the use of about 25 best practices (listed below) — strategies ranging from meaningful health plan cost sharing to the use of delivery system innovations such as telemedicine and surgical centers of excellence.

When 1,121 large employers (those with 500 or more employees) responding to our 2013 survey were divided into three roughly equal groups based on the number of best practices they have implemented, as shown in the bar graph at the top of this article, the average per-employee total health benefit cost was 8% percent higher for those in the bottom group — those using the fewest best practices — than for those in the top group.

These encouraging findings, similar to the results of our past analyses, lend support to the belief that the slower cost increases of the past few years are partially the result of concerted employer actions. Perhaps this is why, even after the public health exchanges have become a reality, the largest employers — those with the resources to implement the most sophisticated cost-management strategies — remain the most committed to providing health coverage for the foreseeable future. The advent of private health exchanges, which can incorporate many of these best practices, may offer an opportunity for employers of all sizes to benefit from the strategies shown to bend the health cost trend.

* Mercer will release the actual cost growth for 2014 in November, based on employer costs through September 2014. The Kaiser Family Foundation’s survey, released in September, reported a cost increase of 3% for 2014.