Analysis on Improved Gender Equality Benefits in Organizations

While working women continue to earn less money than their male counterparts, the gap is narrowing when it comes to health benefits. Three years ago, we used data from Mercer’s National Survey of Employer-Sponsored Health Plans to examine the difference in benefits between large employers with workforces that are 65% female or more to those with workforces that are 65% male or more. Just under half of the mostly female companies are in health care and a quarter are in the services sector, while mostly male companies are found predominately in the manufacturing industry (52%). The percentage of employees in collective bargaining agreements has remained about the same for the two groups (13% for companies with mostly female employees and 15% for companies with mostly male employees). One workforce statistic has seen some movement since 2013, when the average salary for mostly female companies was about $10,000 less than when the workforce is mostly male; data from our 2016 survey shows the difference is now over $15,000.

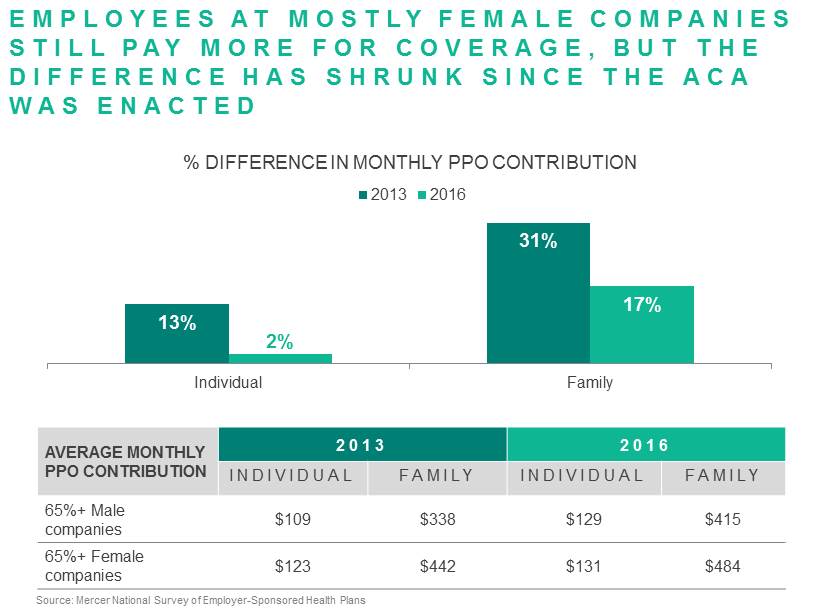

The health benefits at organizations with predominantly female workforces continue to be less generous than in those with predominantly male workforces. In addition, the employee contributions for these less generous plans are higher than those for the richer benefits offered to employees at mostly male companies. For coverage in a PPO, the most common type of medical plan, the monthly contribution for family coverage is 17% higher ($484 for mostly female companies and $415 for mostly male companies), which is down from a 31% difference in 2013.

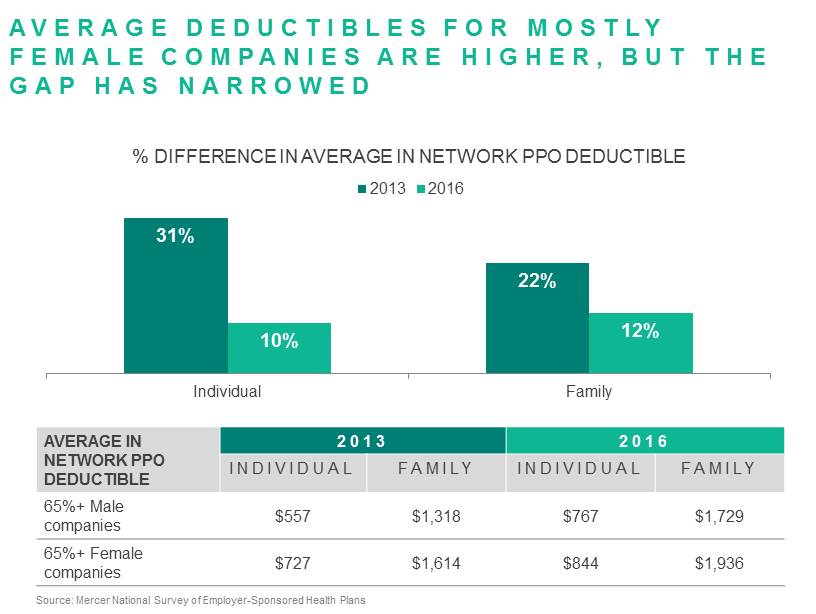

In addition, average in-network and out-of-network deductibles and out-of-pocket maximums are consistently higher. For example, the average in-network PPO deductibles in mostly female companies are $844 and $1,936, respectively, for individual and family coverage, compared to $767 and $1,729 at mostly male companies. While the average deductibles for mostly female companies are still higher, the gap has narrowed when compared to 2013 average deductibles.

While benefits for mostly female companies continue to be less rich and more expensive overall, the gap between these benefits and those for mostly male companies does seem to have narrowed since 2013 and since the implementation of the ACA’s employer shared responsibility affordability and minimum values rules, which set thresholds for the amount an employer can charge an employee for their health plan and for the percent of charges the health plan must cover, broadly speaking. However, the gaps in health plan benefits and costs still exist -- and are compounded by the lower salary levels for employees in companies with higher concentrations of women workers.