Average HMO Cost Has Dipped Below PPO Cost. What’s Up with That?

HMOs provide richer coverage than PPOs and traditionally have been more expensive. Over the past two decades, that fact has led employers in many parts of the country to drop HMO options from their medical plan offerings. Just 14% of all covered employees were enrolled in HMOs in 2018, down from a peak of 33% back in 1996, according to Mercer’s National Survey of Employer-Sponsored Health Plans.

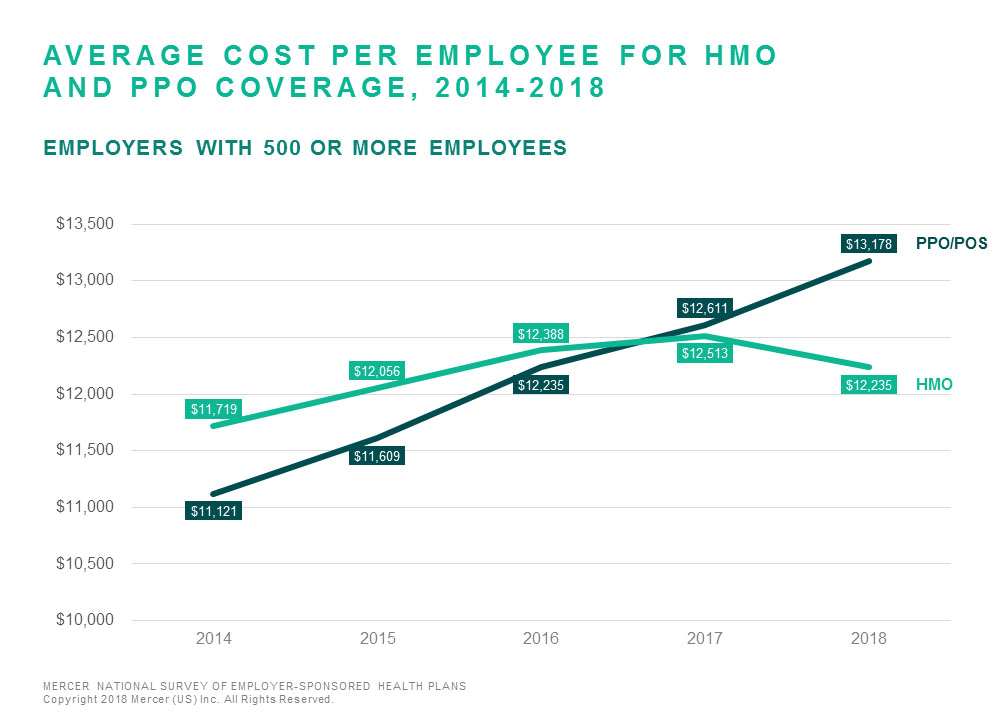

But in 2017, HMO coverage cost a little less than PPO coverage and in 2018 it cost a lot less — on average, $12,235 per employee vs $13,178 among large employers (500 or more employees). HMOs do tend to draw healthier enrollees who are less concerned about closed provider networks (the average age of employees electing HMO coverage in 43, compared to 44 for those electing PPO coverage). But this has always been true, so it doesn’t explain the change in the relative cost of PPOs and HMOs.

What’s going on? Over the past few years, HMOs have been incorporating greater levels of employee cost-sharing, which would help to close the cost gap. But on average HMOs still provide a richer benefit than PPOs, with an average actuarial value of 94 percent compared with PPOs’ 87 percent. Just 41% of large HMO sponsors require a general deductible, while nearly all PP plans do. With the HMO’s traditional focus on providing easy access to primary care, the average physician office copay is still only $22. While the use of PCP “gatekeepers” to approve access to specialists – a largely unpopular provision – is on the decline and the majority of plans (59%) now use a higher specialist copay to manage utilization, even that is a relatively modest $39 on average. So it doesn’t seem that plan design alone explains the difference.

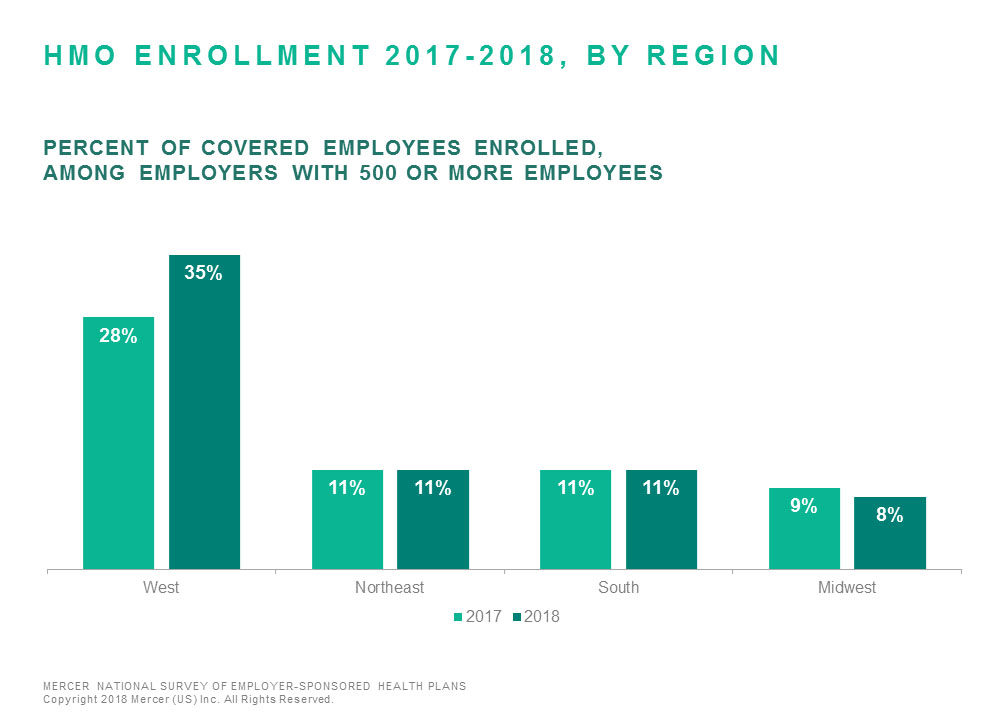

Ironically, the key to the improvement in average HMO cost relative to PPO cost may be the contraction in the HMO market. Over time, HMO enrollment has become increasingly concentrated in the West, where mature, staff model HMOs using capitation are dominant. In the West, the difference in average cost per employee between HMOs and PPOs exceeds $1,600. Outside of the West, HMOs more typically use fee-for-service reimbursement, and the cost differences between HMOs and PPOs are negligible. But the higher HMO enrollment in the West – 38% of covered employees compared to just 8% in the Midwest and 11% in both the South and Northeast – means higher-performing HMOs are reflected in the national cost.

We’ll have to wait and see if the favorable HMO cost trend continues. The most optimistic interpretation of these recent results would be that, done well, the foundational elements of the HMO concept — integrated services and data sharing; provider accountability for care coordination; and reimbursement methods other than traditional fee for service — truly can deliver lower cost for both the member and the plan sponsor. That would offer encouragement to employers that have incorporated Accountable Care Organizations or other high-performance networks into their health plan strategies, since these networks are built around the principles that may be driving lower costs in HMOs. About a fifth of large employers say employees have a choice of a high-performance provider network other than an HMO at open enrollment. But, unlike in HMOs, many ACOs or other high performance networks permit employees to choose providers outside the network. The challenge for employers is to provide members with the education and incentives to maximum ACO utilization. For their part, ACOs need to more clearly demonstrate their value so that employers can act with confidence.