Closer Look at the Biden Plan: Exchange Tax Credits and Affordability

A few weeks ago, Tracy Watts discussed some key items on Joe Biden’s healthcare agenda. The agenda is broad with some details. His proposal has a clear focus on providing more Americans with more affordable health coverage, in part by:

- Making tax credits for public exchange coverage available to people with higher household incomes than is currently allowed, and

- Creating a “Medicare-like” public option plan

The campaign website states that people covered in an employer plan would be able to choose an exchange plan or the public option if they could get a better deal. Sounds reasonable – but how would that work? Further, what might be the impact on employer plans of people being able to switch in and out? Without getting into all the issues, we decided to “do the math” on these proposals to see how new coverage options might compare, from an employees’ perspective, with the typical employer-sponsored plan today. I will look only at changes proposed for the public exchange in this post and save the public option for later.

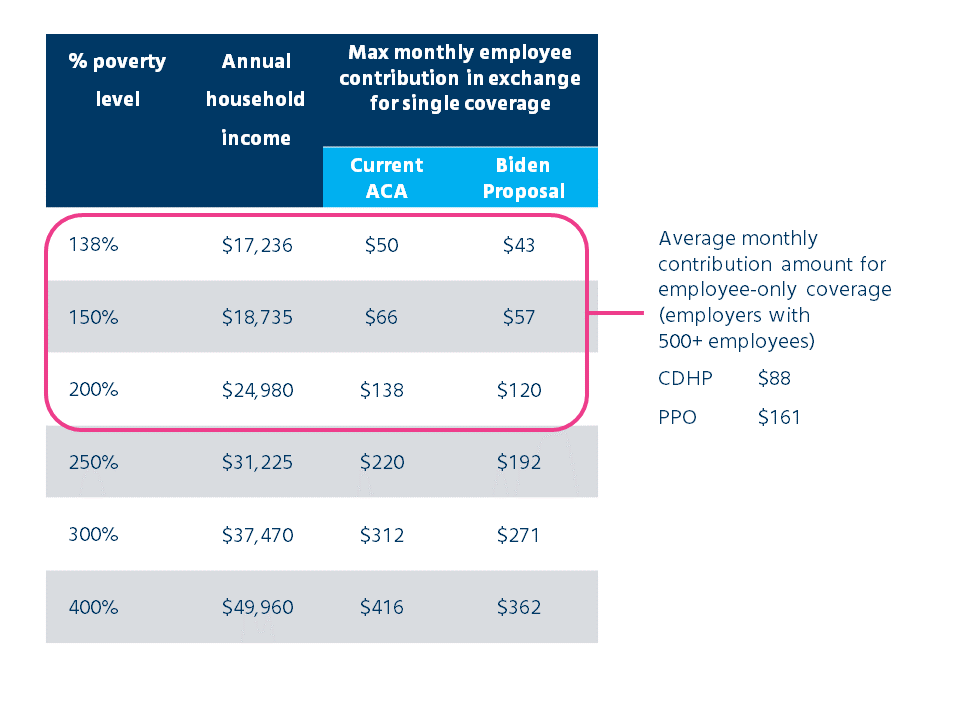

Biden’s proposal would remove the upper threshold for receiving tax credits on the exchange - currently at 400% of the poverty level – and base these credits on the gold plan rather than the silver. He would also bring the affordability threshold down from 9.83% to 8.5% for purposes of the premium tax credit. It’s not clear whether he intends for that cap to also apply to the employer’s ACA affordability safe harbor for employer-shared responsibility purposes, but let’s assume he does for purposes of this blog.

The campaign website states: If a family is covered by their employer but can get a better deal with the 8.5% premium cap, they can switch to a plan on the individual marketplace. Certainly, for people in very low-income households, premium costs for exchange coverage under the Biden proposal would be even lower than they are currently relative to average contributions required for employer-sponsored coverage. Starting at 250% of FPL, however, premium costs on the exchange are higher than employer coverage.

And, of course, contributions aren’t everything. Consider what you get for these prices: significantly higher deductibles than the median deductible in large employer (500+ employees) PPO plans, and higher out-of-pocket maximums than the medians of either PPOs or CDHPs.

| Features (Individual) | Employer Plan:PPO Option | Employer Plan:CDHP Option | Public Exchange: General Silver Plan |

Public Exchange: General Gold Plan |

|---|---|---|---|---|

| Deductible | $750 | $2,000 | $5,000 | $1,350 |

| OOP Max | $3,400 | $4,000 | $8,000 | $6,800 |

Finally, exchange plans often utilize narrower networks than employer plans to help keep costs down, which can significantly affect member satisfaction with the plan.

Employers should watch for changes to the affordability threshold for employee contributions, since that’s currently linked with the safe harbor many plan sponsors use to maintain compliance with the ACA employer mandate. For 2021, the Federal Poverty Level (FPL) affordability safe harbor for the mainland US is: ($12,760 x 9.83%) / 12 = $104.53. That’s the magic threshold that, barring opt out credits and/or certain wellness incentives, provides a cap on employee contributions for single coverage in order for the employer to meet the FPL affordability safe harbor. But if Biden wins and Congress agrees to drop the 9.83% in the formula above to 8.5%, that could leave us, for example, with a maximum employee contribution for affordability purposes of $90.38 in 2021. That’s potentially a 14% decrease in employee contributions, which could lead employers to shift cost-sharing elsewhere.

Enough numbers for now? We’ll do the math on the public option plan in a future post.