Employers Launch Worksite Clinics Despite ACA Uncertainty

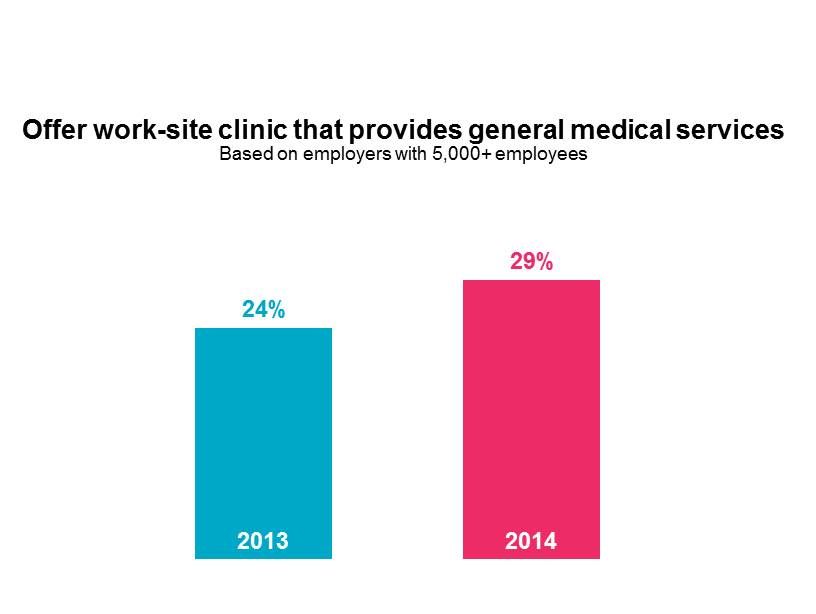

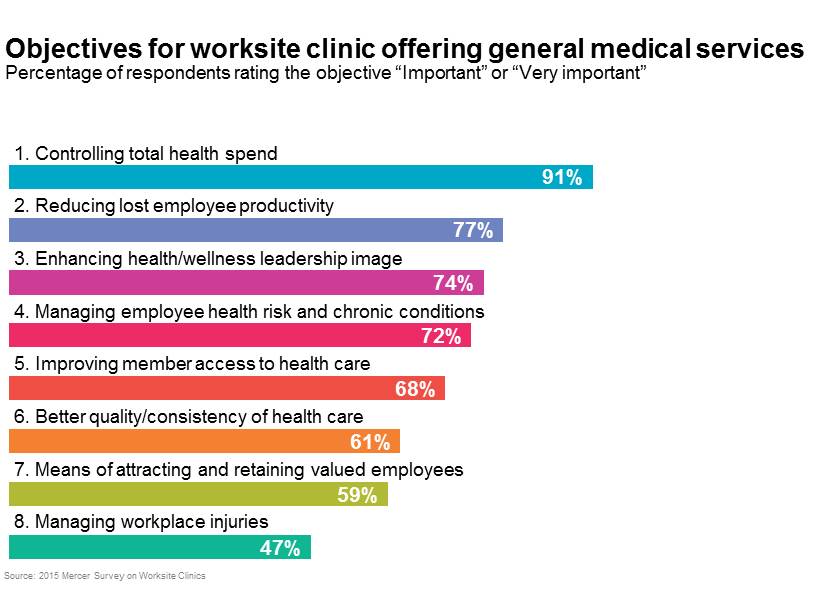

When employers are asked how they plan to control health benefit cost over the long term, they talk about improving employee health. This focus on employee health is one factor fueling growth in worksite clinics. Last year, Mercer’s National Survey of Employer-Sponsored Health Plans found that 29% of employers with 5,000 or more employees provided an onsite or near-site clinic offering primary care services, up from 24% in the prior year. Mercer followed up with these employers in a new, targeted survey on worksite clinics. Of the 134 respondents, 72% of those whose clinics provide general medical services said that managing employee health risk and chronic conditions is an important objective for the clinic.

Worksite clinics are a convenient way for employees to undergo biometric screenings (offered at 77% of clinics), participate in face-to-face chronic condition coaching (60%), and take part in lifestyle management programs such as smoking cessation (59%) or weight management (56%). Pharmacy services are offered at 38% of clinics, and just over a fourth (26%) provide mental health or employee assistance program (EAP) counseling in their clinics.

For more than two-thirds of survey respondents (68%), improving access to care was also an important objective. As the Affordable Care Act (ACA) expands health coverage to more Americans, primary care shortages in some parts of the US could be exacerbated. Establishing a new clinic, or expanding an existing occupational health clinic to provide general medical services, is one way employers can ensure that their employees — and in some cases employees’ dependents — will have access to quality care.

While the ACA may have spurred employer interest in worksite clinics, an IRS notice released this February has clouded the picture by suggesting that the cost of care received through the clinic must be counted in the ACA’s excise tax calculation. Some respondents (15%) believe their general medical clinic will hurt them in terms of the excise tax calculation by pushing them over the threshold for the excise tax, and some (11%) believe it will help, presumably by holding down the cost of the company’s health plan. Another 28% believe it won’t have an impact either way, and 46% simply don’t know how the clinic will affect the calculation. Typically, the cost of the clinic accounts for 10% or less of an employer’s total health care spend and for about half of the respondents, it accounts for 5% or less.

Measuring clinic success

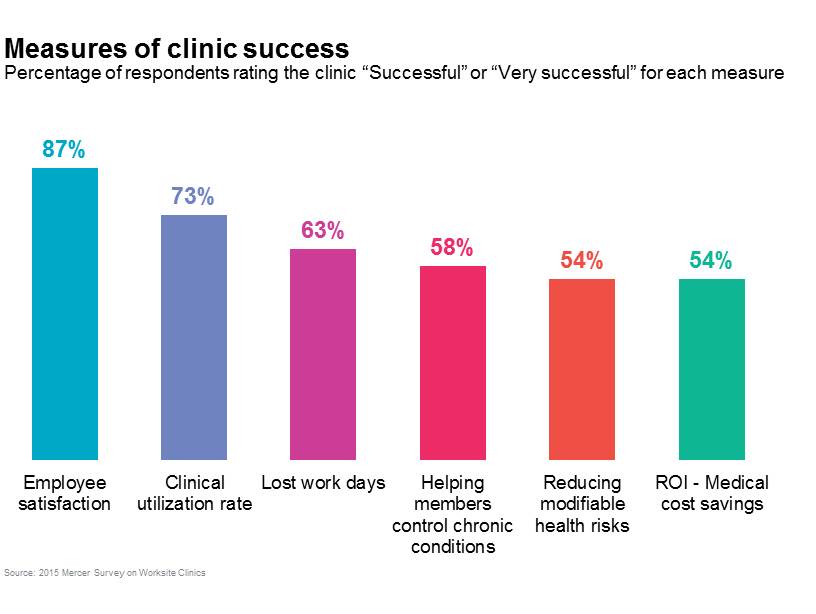

The great majority of respondents — 85% — say that their organization generally perceives the clinic as a success. Specifically, 63% say it has successfully reduced lost work days, and 58% say it has been successful in helping members control chronic conditions.

Measuring return on investment (ROI) remains a challenge for employers, and only 41% of respondents were able to provide ROI data. An ROI of 1.00 to 1.99 was most common (23% of respondents reported ROI in this range), and 13% percent reported an ROI of 2.00 or higher. Only 5% have an ROI of less than 1.00.

The best measure of employee satisfaction may be utilization. Respondents report that 45% of employees, on average, used the clinic in 2014. Nearly half of respondents (48%) with a general medical clinic don’t require any copayment for clinic services, and 25% require a lower copayment than the employee would pay for comparable services under the company health plan. The majority of respondents with hourly employees (61%) do not require them to clock out of work for visits to the clinic.

For many employers, employee satisfaction is a more important measure of success than ROI. If employees are using the clinic, it means they haven’t been taking time off work to visit a doctor, and that they’re getting the medical care they need to stay healthy and productive.