Final Drug Pricing Changes Sought by Trump Administration

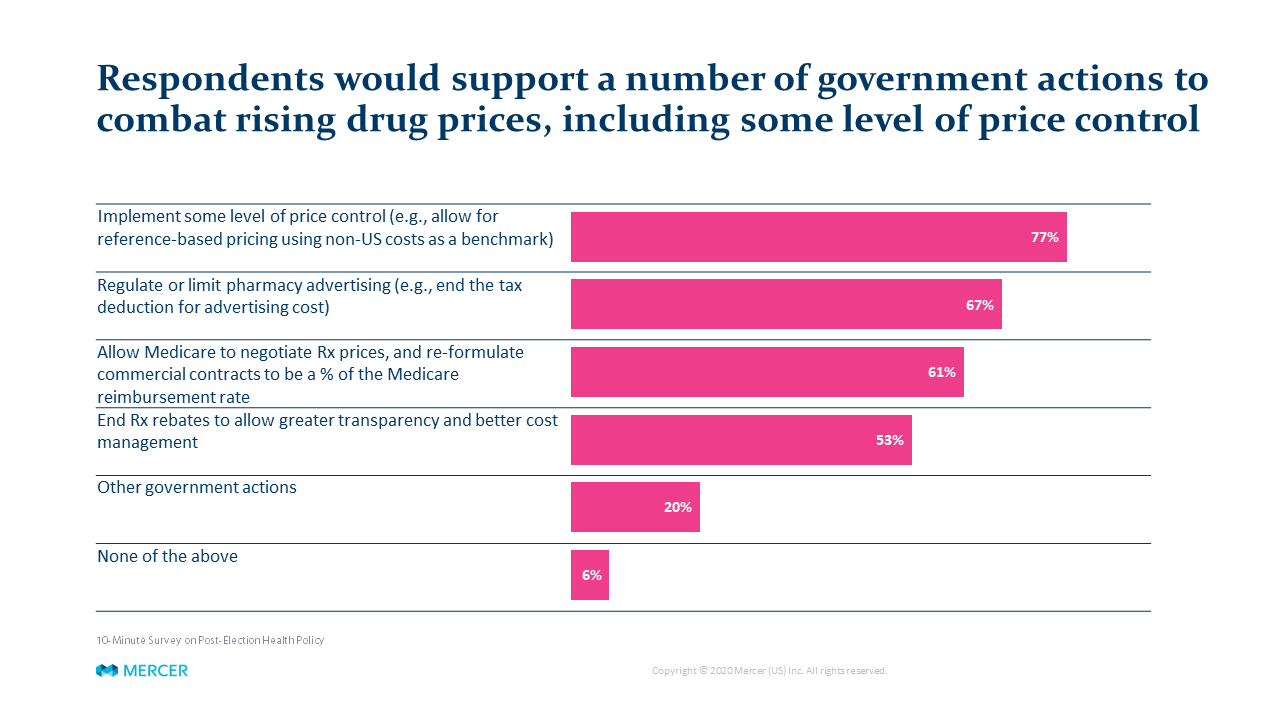

Regardless of political beliefs, one item both parties can agree on is that drug-pricing policy is a major issue – usually ranking either #1 or #2 in employers’ benefits priorities. A recent Mercer employer survey found a surprisingly large portion of private sector plan sponsors – more than three-fourths of those responding – support more direct government regulation of drug prices.

Over the last four years, the Trump Administration has proposed many disruptive changes in drug pricing policy, such as requiring manufacturers to list prices in their advertising and redirecting rebates provided by drug makers from pharmacy benefit managers (PBMs) and other players to Medicare Part D participants. However, for a variety of reasons, none of these proposals were implemented.

As the current Administration's days wind down, it issued two sets of regulations on this issue in late November. The first regulation is a final rule relating to Medicare Part D rebates; the second regulation is an interim final rule – subject to a comment period – relating to Medicare Part B drug pricing. Neither rule has an immediate impact on private sector plan sponsors or Medicaid; they each could have an indirect impact if adopted.

Medicare Part D Rebate

This rule redirects drug manufacturer rebates currently received by Medicare Part D plan sponsors or PBMs to patients taking the medications. Pharmacy administrators (such as PBMs) could still receive fees for their work but could not receive rebates. The Administration rationale is that rebates actually inflate costs as drug makers increase the list price to fund the rebate they need to pay—not unlike the “manufacturer’s suggested retail price’ on a car. Some observers believe that, as prices may decline for Medicare, drug makers might shift costs to the private sector. Additionally, the Administration seems to assume that all manufacturers would act similarly regarding pricing policy—reducing list price if rebates must be passed through to enrollees. The rebate-related portions of the rule are not effective until January 1, 2022.

Most Favored Nation Reference-Based Pricing

This rule only applies to certain Medicare Part B drugs—largely injected or infused drugs administered in a physician’s office or an outpatient hospital setting. The written guidelines are very complex, but the gist of the rule is:

- As part of a Medicare 7 year demonstration model, Medicare reimbursements to drug makers for 50 specific Part B drugs would be based on prices (adjusted for certain items like per capita GDP and actual volume by country) in other developed countries like the UK, Germany, France, Japan, South Korea and others

- The pricing reforms would be phased in by 25% per year for years one through three, reaching 100% of the set price in years four through seven.

- This rule has no immediate impact on the private sector or Medicaid

It should be noted that the incoming Biden Administration has not commented on these rules and whether they will be revised or rescinded. Since the Medicare Part D rule is not effective until January 29, 2021—after the Biden Administration begins—the new Administration likely has the ability to change, delay or rescind the rule before it becomes effective. Even if implemented as is, we anticipate litigation challenging various aspects of the rule.

While the Medicare Part B rule was effective on November 27, 2020, there is a comment period for the rule that ends on January 26, 2021, giving the new Administration some leeway on determining the future of the rule. Be aware also that on December 4, 2020, the Pharmaceutical Researchers and Manufacturers of America (among others) filed a lawsuit in Maryland, seeking to invalidate the rule.

The increasing focus on drug pricing by both parties may yet bring changes at some point. As welcome as some of those reforms to public programs may be, they may have unintended consequences in terms of cost shifting or PBM marketplace practices that could adversely affect plan sponsors.