Health Benefit Costs Expected to Grow 4.4% in 2021, Mercer Survey Finds

I’ve worked on Mercer’s National Survey of Employer-Sponsored Health Plans for a long time now, but it’s still exciting, after all the months spent developing the questionnaire, fielding it and waiting for responses, to get that first look at the results. It’s kind of like opening a present: You hope you’re going to like it, but there’s always a chance it will be an ugly sweater.

This year the fear of an ugly sweater was greater than usual, because COVID. In particular, we wondered about employers’ cost projection for 2021, given all the unknowns facing health plans. The survey was fielded in the summer, when health care utilization was just starting to pick up after grinding to a near-halt in the spring. Self-funded employers were (and still are) challenged to estimate where their 2020 costs would end up relative to budget, let alone to project the change in cost for 2021. Different assumptions about next year’s utilization rates and COVID-related costs – such as for a new vaccine – could mean wide variations in cost projections.

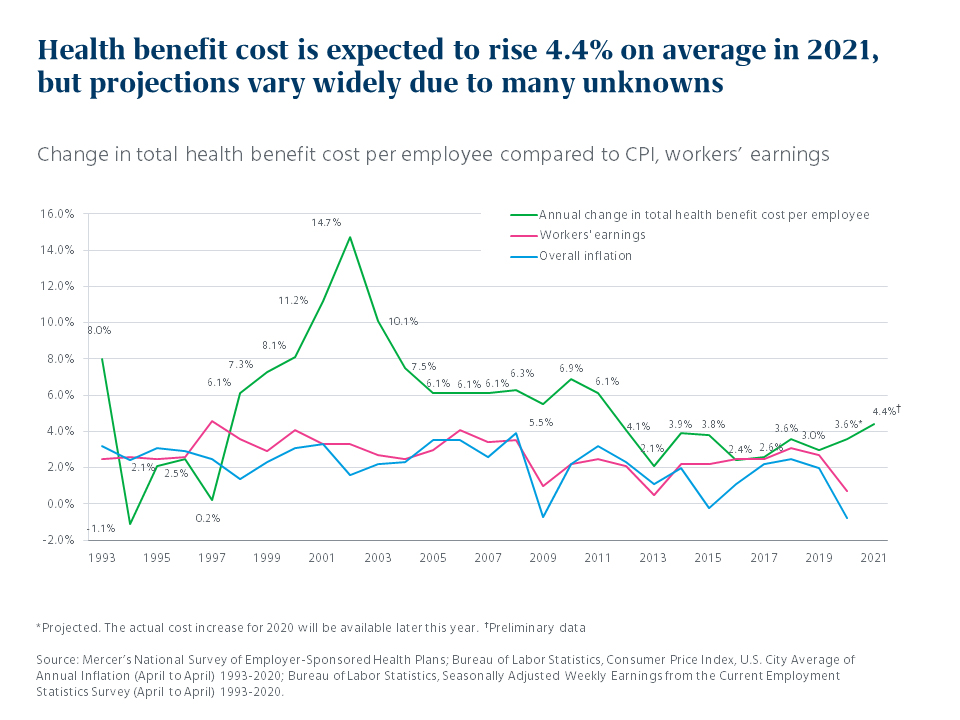

That’s why it was something of a surprise to find employers projecting – on average – a fairly “normal” increase of 4.4%. Based on 1,113 surveys submitted through the end of August, this increase is only slightly higher than the generally moderate cost growth we’ve seen over the past six years. What is different this year is the context: Health benefit cost growth is now far outpacing the Consumer Price Index and wage growth, which have fallen to nearly zero.

Few employers will cut benefits to slow cost growth next year

There was speculation earlier this year, amid the rash of furloughs and layoffs, that economic stress would lead to deep cost cutting in health plans in 2021. But – in another pleasant surprise – only 18% of employers responding to the survey say they will take cost-saving measures that shift more healthcare expense to employees, such as raising deductibles or copays. In fact, the majority of survey respondents (57%) will make no changes whatsoever to reduce cost in their medical plans in 2021 (compared to 47% making no changes last year, and just 44% in 2018). Along with what my Mercer colleagues are hearing from clients, these results suggest employers are putting big changes on hold this year given all the turmoil their employees have been through and continue to face.

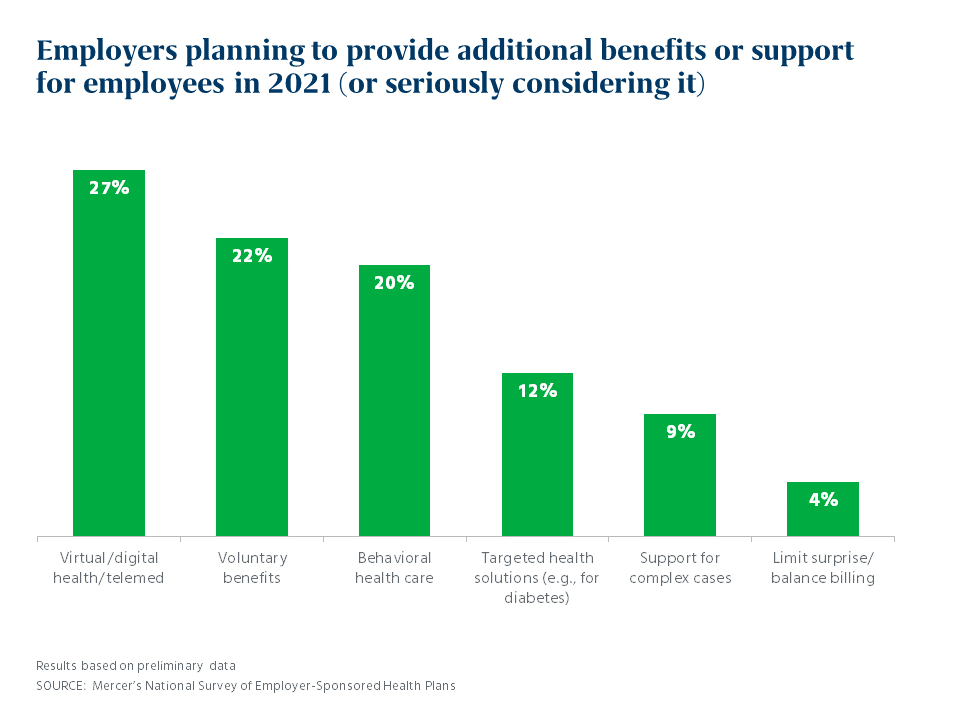

In fact, many are adding new resources to support and engage their workers in the COVID era. At the top of the list: Virtual office visits and other digital healthcare resources. More than a fourth of all respondents (27%) and well over a third of the largest employers (37% of those with 5,000 or more employees) are adding or improving digital healthcare resources,such as telemedicine for episodic care, artificial-intelligence-based symptoms triage, ‘text a doctor’ apps and virtual office visits with a patient’s own primary care doctor. The pandemic has proven not only that we need virtual care, but that providers and patients will embrace it once they try it.

Other enhancements planned for 2021 by responding employers include voluntary benefits (22%), such as critical illness insurance or a hospital indemnity plan and adding or improving behavioral healthcare resources (20%). More than half of employers (59%) have provided managers with training on how to support employees’ emotional and behavioral health since the onset of the pandemic, or are planning to do so.

With schools and daycare schedules disrupted across the country, 45% of responding employers are permitting flexible schedules to allow parents to care for children during daytime working hours. However, even among the largest employers (5,000 or more employees, who tend to offer more generous benefit programs), just 16% provide a financial subsidy for in-home childcare, and only 12% provide a back-up childcare benefit.

The take-aways (for now)

These are just a few of the survey findings, based on preliminary data. As of September 30, over 1,800 employers have participated and we will release the comprehensive results later this year. For now, here are our key take-aways:

- Many employers are avoiding health plan changes that impact employees this year and are focused on supporting employees as they cope with the strain of the pandemic.

- Employers are turning in growing numbers to digital health resources, for their convenience, safety, and efficiency.

- Cost projections for 2021 may be less reliable than usual. Plan member stress and care avoidance in 2020 may result in higher utilization in 2021, and struggling health systems may seek to recoup lost revenue through higher prices. As employers seek to balance economics and empathy, managing cost must remain a priority.

We’ll be excited to share what more we learn about the program strategies employers are using in the COVID era – once we open the rest of the presents.