HSA Plans and Onsite Clinics Can This Marriage Be Saved

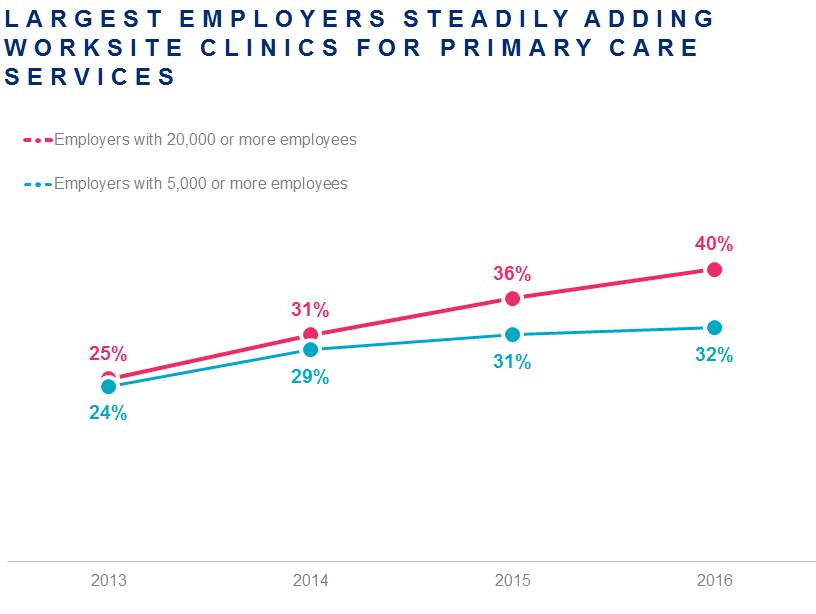

Offerings of HSA-eligible high-deductible health plans have more than doubled in the past five years. Our 2016 National Survey of Employer-Sponsored Health Plans found that more than half of large employers (53%) now provide this type of plan to their employees, and nearly a quarter of employees (24%) are enrolled. At the same time, there has also been steady growth in offerings of onsite and near-site medical clinics, especially among the largest employers: About a third of employers with 5,000 or more employees provide a clinic for primary care services. An onsite clinic offers the maximum opportunity for control over quality, and more than half of the clinic sponsors in another Mercer survey said that their clinic is integrated with their population health efforts.

Employers that offer HSA-eligible plans and provide onsite care face unique challenges. Under rules for HSA-eligible plans, only preventive services can be provided at no cost; employees need to pay the full cost of a non-preventive visit before they satisfy the plan deductible. Some employers with onsite clinics may be unknowingly disqualifying employees, understating their own tax liability, and incorrectly filing employment tax forms.

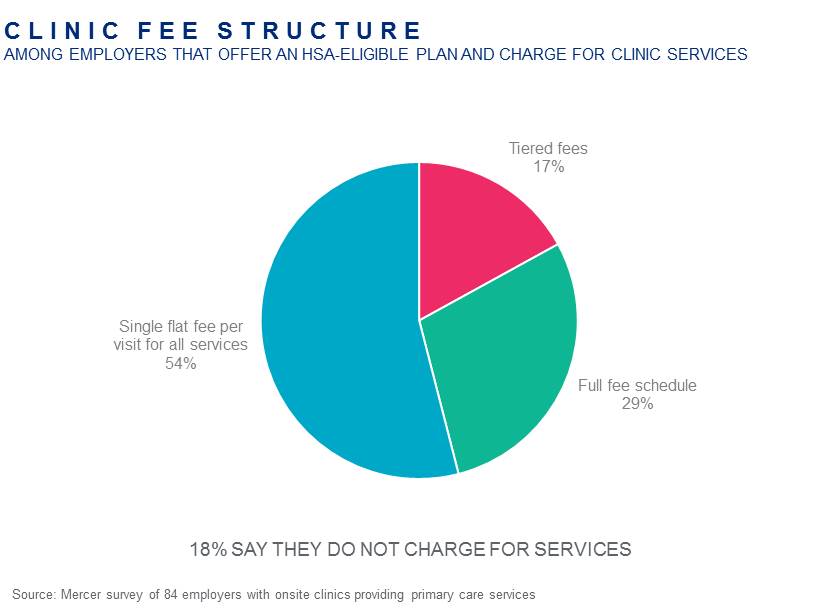

It remains to be seen if lawmakers will loosen regulations to make coordinating clinics and HSA-eligible plans easier. In the meantime, we surveyed 84 organizations that have onsite clinics and asked how employees are charged for clinic services. Of those respondents that offer both an HSA-eligible and non-HSA eligible plans, nearly two-thirds say that members are charged the same amount for clinic services, regardless of plan selection, though a third responded that members in the HSA-eligible plan are generally charged more. More than half of these employers that offer HSA plans charge a single, flat fee per visit for all services, 29% have a full fee schedule, and the remaining 17% have a tiered fee structure. Nearly a quarter of respondents use third-party services for billing, and just over half require full payment for clinic services at the point of sale.

Employers with onsite clinics that are considering adding an HSA-eligible plan will need to revisit their clinic fee structure and billing practices to ensure clinic use is compliant with plan eligibility -- at least until these regulations are updated… fingers crossed!