HSAs: Full Replacement or Choice

While it’s far from clear where the incoming administration and Congress will land on the “replace” part of “repeal and replace” with regard to the Affordable Care Act, they are signaling interest in promoting the use of health savings accounts by expanding eligibility and allowing funds to be used for more purposes. High-deductible HSA-eligible plans already feature in many employer health benefit programs.

In 2016, 21% of all covered employees were enrolled in an HSA-eligible plan. Enrollment has been rising over the past decade as employers -- especially large employers (500+ employees) -- have added HSA-eligible plan choices to their health programs. The threat of the excise tax was a big motivator for employers to move employees into lower-cost plans; while the excise tax may go by the wayside, there is now discussion of capping the individual tax exclusion for employer-provided health coverage, which could still drive cost pressure on employer-sponsored health plans.

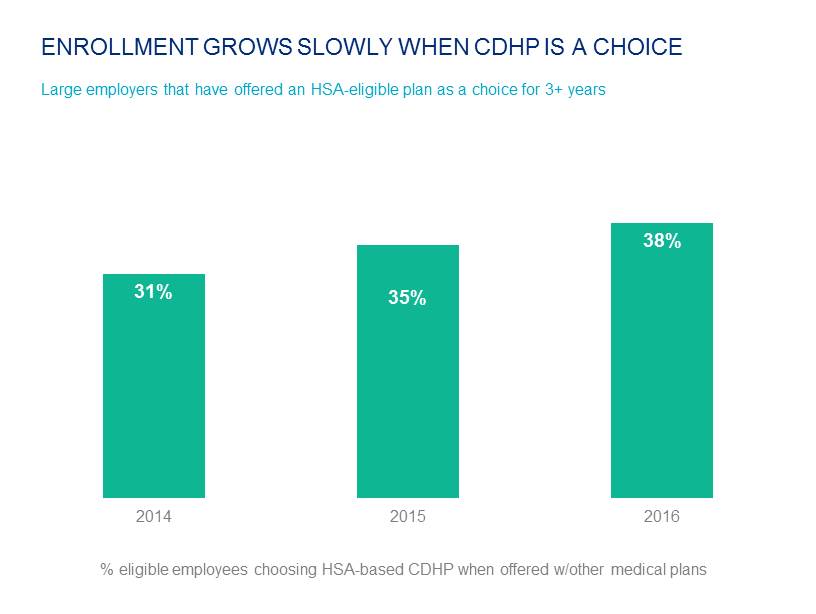

It is relatively uncommon for a large employer to offer an HSA-eligible plan as the only plan. Many are concerned that these plans might not be a good fit for all employees in their population. In fact, among employers that have offered an HSA as a choice for at least three years, average enrollment has only reached 38% of covered employees -- even though employee paycheck deductions for these plans are significantly lower. Among large employers, for employee-only coverage in an HSA-eligible plan, employees contribute $84 per month on average, compared to $132 for PPO coverage. For family coverage, the difference is $321 vs. $467. In addition, 75% of large employers offering HSA-eligible plans make a contribution to the employees’ HSA -- typically $500 for an individual.

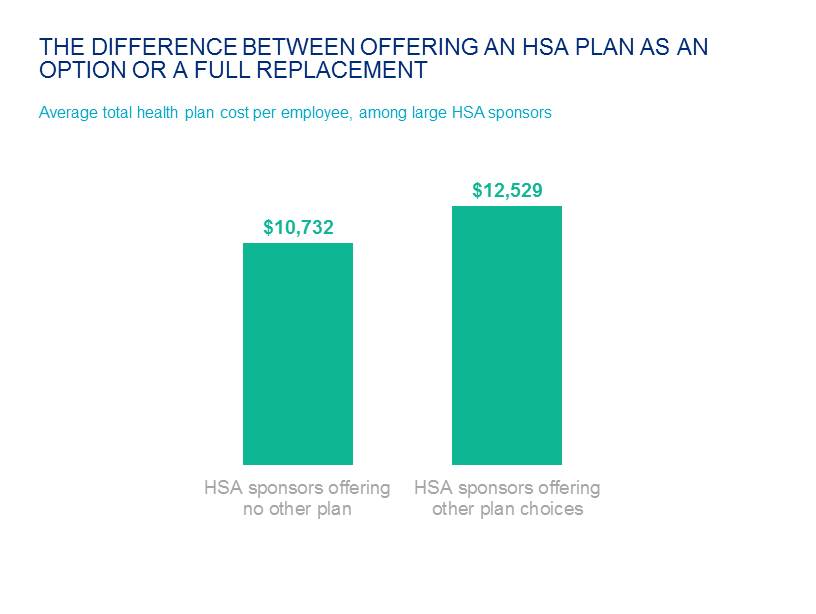

While per-employee cost for these plans is 22% less, on average, than cost for a traditional PPO, some employers question whether the savings are due largely to selection -- the tendency of younger, presumably healthier employees to choose the HSA plan over a richer PPO or HMO. It is true that when the HSA plan is offered as a full replacement, the average HSA cost is higher than when it is offered as a choice. But perhaps the more meaningful comparison is total health cost per employee -- the cost for all enrolled employees across all medical and dental plans. Among large employers offering an HSA-eligible plan as a choice, total health benefit cost averages $12,529; among those offering a full-replacement HSA, it averages $10,732. Plan design and other factors may account for this difference in cost, but not selection. Studies have shown that the higher cost-sharing levels in an HSA-eligible plan are associated with lower utilization of health services. It has not been demonstrated if, or how, this lower utilization affects the health of enrollees.

Changes in health policy may well have employers reconsidering a full-replacement strategy. And while many employers that already offer these plans also provide financial planning resources, transparency tools, and resources such as telemedicine to help mitigate employees’ growing financial risk, the fact remains that for employees without sufficient savings and significant health expenses, a high-deductible plan can result in financial hardship. On the other hand, for many employees, the HSA is an extremely efficient way to save for future health expenses, and may become even more so under the new administration. The key to making the decision to offer an HSA alone or as a choice is understanding employee needs and preferences, as well as the new resources that are available to help make HSAs work better for everyone.