More Employees Chose CDHPs in 2016, Slowing Cost Growth

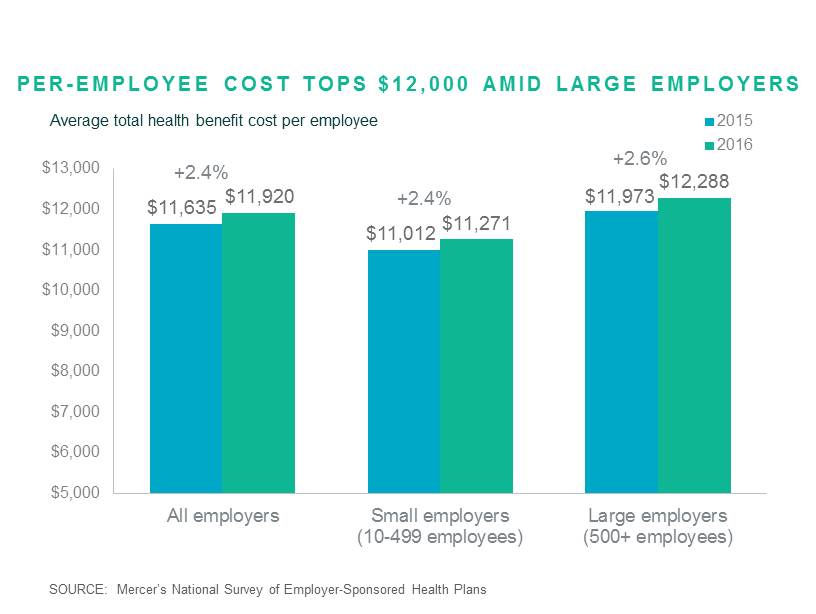

More employees moving into lower-cost medical plans contributed to one of the smallest increases in total health benefit cost per employee in decades: 2016’s average increase of 2.4% is the lowest since 2013 and, before that, since 1997. According to Mercer’s survey, total health benefits cost averaged $11,920 per employee in 2016. This cost includes both employer and employee contributions for medical, dental and other health coverage, for all covered employees and dependents. Small employers (10-499 employees) again reported lower cost -- $11,271 -- compared to $12,288 for large employers with 500 employees or more.

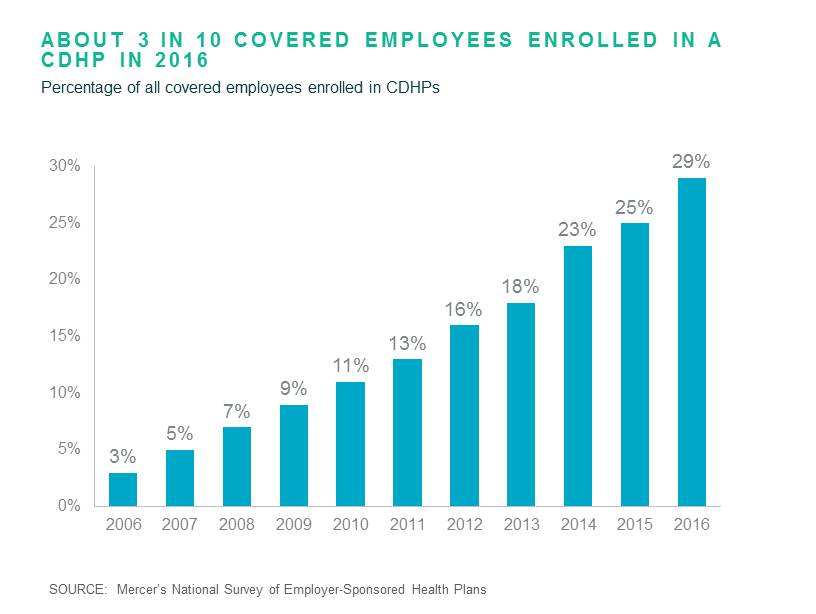

While many factors contributed to the low cost increase, including general inflation hovering around 1%, one that is drawing attention is the accelerating movement of employees into high-deductible consumer-directed health plans (see this article in the New York Times). CDHP enrollment has been rising for a decade and in 2016 jumped to 29% of all covered workers, up from 25% in 2015.

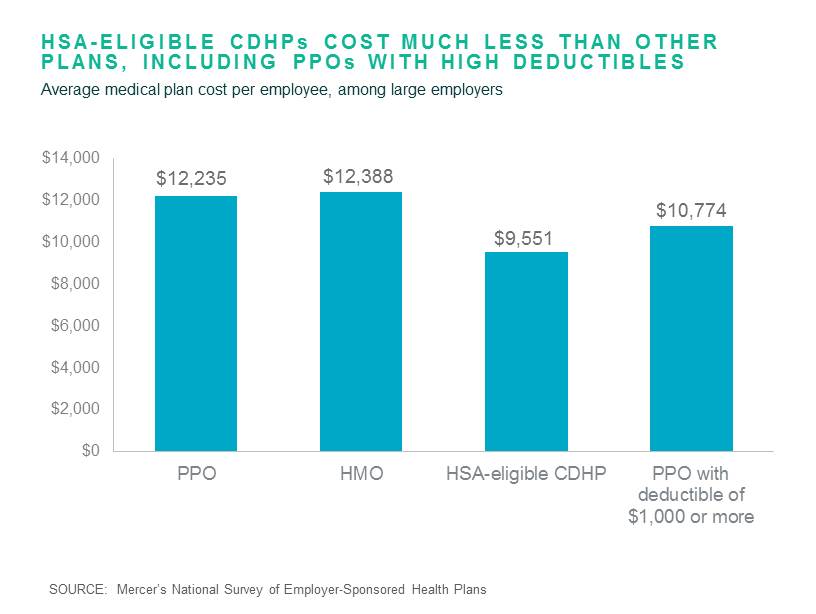

Adding CDHPs has been a key strategy for employers concerned about the ACA’s excise tax on high-cost plans. Coverage in a CDHP that is eligible for a health savings account (HSA) cost 22% less, on average, than coverage in a traditional PPO plan among large employers, even when employer contributions to employee HSA accounts are included. The largest employers have moved the fastest: Among organizations with 20,000 or more employees, 80% offer a CDHP and enrollment jumped from 29% to 40% of covered employees in 2016.

Despite the CDHP’s lower cost, most employers continue to offer it as a choice and not as a full replacement. While 61% of large employers now offer a CDHP (up from 59% last year), just 9% offer it as the only plan available to employees. This suggests that most of the latest growth in CDHP enrollment came from employees choosing to move from a traditional PPO or HMO. For employees, the difference in the cost of coverage can be substantial – on average, more than 30%. Among large employers, for employee-only coverage in an HSA-based CDHP, employees contribute $84 per month on average, compared to $132 for PPO coverage. For family coverage, the difference is $321 vs. $467. In addition, 75% of large employers offering HSA-eligible CDHPs make a contribution to the employees’ HSA; typically $500 for an individual.

For employees who can manage the high deductible, a CDHP can be a financially smart move. Employers can make it easier to choose a CDHP by offering resources to help employees manage their spending on healthcare. In our next post on the survey findings, we’ll look at the big increase in offerings of telemedicine, one resource to help employees hold down cost before they hit their deductible.

Mercer recently released key findings from our 2016 National Survey of Employer-Sponsored Health Plans, a nationally representative survey of US employer health plan sponsors with 10 or more employees. More than 2,500 employers participated in the survey in 2016, making it the largest of its kind. The complete survey report and data tables will be published in March 2016 (click here to pre-order), but throughout the year and starting now we will post findings on select topics here.