New Retiree Medical Options Rein in Cost

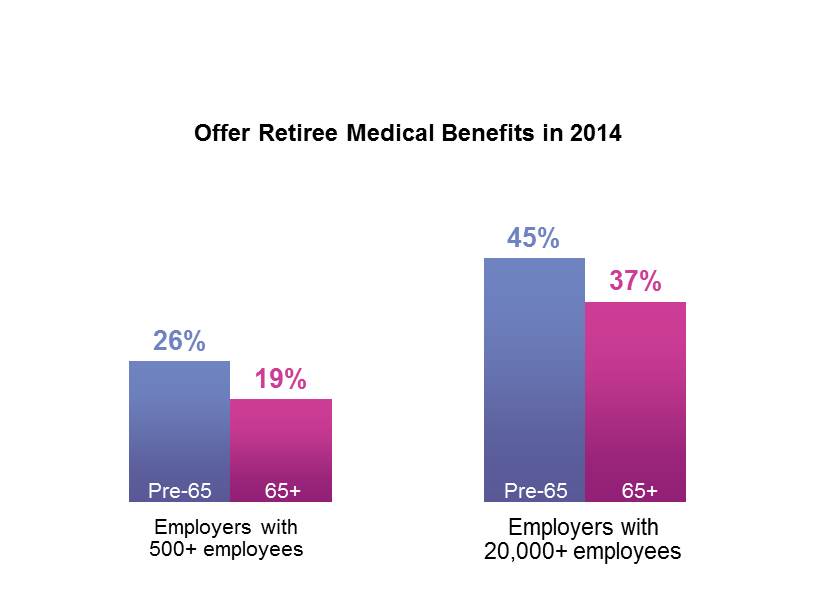

While the percentage of US employers offering retiree medical coverage fell sharply during the 1990s, the downward trend leveled off in the early 2000s. Our most recent survey of employer-sponsored health plans found that about a fourth of all large employers (500 or more employees) and about half of those with 20,000 or more employees offer retiree medical benefits for which new hires are eligible (substantially more continue to cover a closed group of current or future retirees). Many employers that still offer retiree coverage are committed to doing so, whether to honor past commitments, to gain an edge in the competition for talent or as a matter of corporate philosophy. In deciding whether to continue, cut back, or terminate retiree plans, sponsors must keep in mind that older employees see lack of coverage as a barrier to retirement. Our survey results consistently show that the median age at retirement is higher in organizations that don’t offer retiree coverage than in those that do — 65 years compared to 62.

Fortunately, sponsors have new options as they seek to update their programs to ensure that they are sustainable. In the past, offering retiree medical benefits meant sponsoring, administering, communicating, and perhaps financing the plans. Most often employers self-funded retiree plans, exposing themselves to large claim risks. With the advent of prescription drug coverage for Medicare retirees in 2006 and the opening of public exchanges to pre-Medicare-eligible retirees in 2014, employers gained viable options for fully insured, guaranteed-issue individual coverage for their retirees, often at a lower cost for both parties. For these plans, employers were only responsible for subsidizing the coverage, if they chose. In recent years, Medicare Advantage-Prescription Drug (MA-PD) plans have offered comprehensive medical and drug coverage at highly attractive rates for many employers. Private exchanges have proven to be an attractive option for retirees. They are most commonly used to provide coverage to Medicare-eligible retirees: 15% of retiree plan sponsors offer a private exchange to Medicare-eligible retirees, and an additional 17% are considering it.

About a fifth of retiree plan sponsors (22%) provide separate medical plans for actives and retirees; more typically actives and retirees are offered at least some of the same plans. Consequently, the portion of retirees with access to CDHPs is growing. In 2014, 25% of sponsors offered an HSA-based CDHP to pre-Medicare-eligible retirees, up from 21% in 2013. While CDHPs for Medicare-eligible retirees are less common, offerings grew sharply in 2014, rising to 18% of retiree sponsors, up from just 7%. When active employees have experience with HSAs for several years before they retire, providing them with the same option (usually without employer HSA funding) after makes sense.

Survey results suggest that all these options are adding up to cost savings for employers. In our 2014 survey, among the 121 large sponsors providing two years of cost data for pre-Medicare-eligible retirees, cost averaged $12,301 per retiree in 2014, an increase of just 1.7% from 2013. For the 94 large sponsors providing data for their Medicare-eligible retirees, cost actually decreased by 3.9%, to an average of $5,118 per retiree. While one reason for this surprising result may be slow growth in prescription drug cost, another might be a change in the mix of plans offered, if some employers in this group with very high-cost plans in 2013 choose to shift to an MA-PD plan or another lower-cost option in 2014.

All of which provides food for thought for employers that may have once thought the only solution to the retiree medical benefit cost problem was to drop coverage.