Preparing for the 2018 Excise Tax

The results of Marcer`s latest National Survey of Employee Sponsored Health Plans are now ready to share, and we`ll be using this spacee to showcase the insights in the coming weeks.

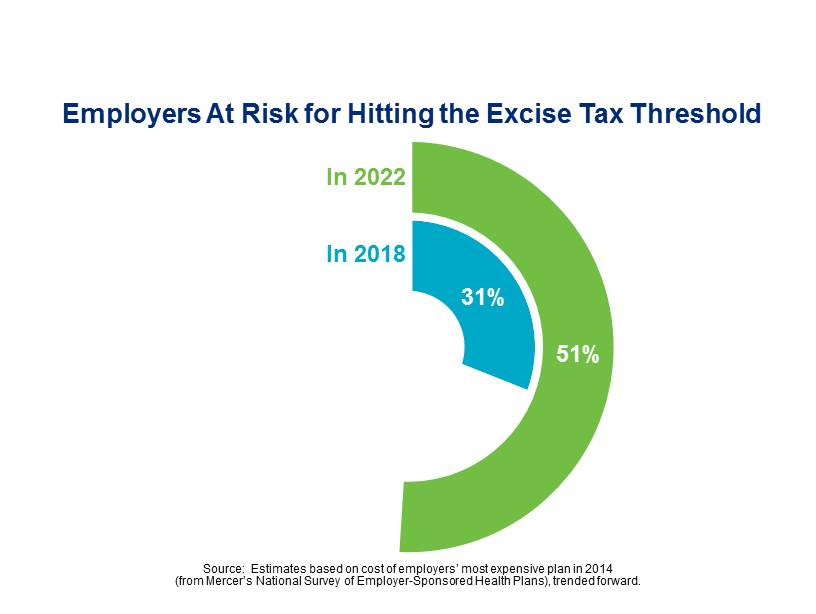

To estimate how many employers are at risk for hitting the cost threshold, we asked them to provide the premium cost for individual and family coverage in their most costly plan, then trended that cost forward to 2018 and beyond. In 2018, the year in which the so-called “Cadillac tax” is slated to kick in, a 40% excise tax will be imposed on the cost health coverage in excess of $10,200 for an individual or $27,500 for a family. Overall, we estimate that 31% of employers are currently at risk for triggering the tax in 2018 if they make no changes to their most costly plan — and that number rises to 51% by 2022. (The excise tax cost threshold is indexed to CPI, but health benefit cost typically rises at a faster rate.)

Risk for triggering the tax varies significantly by industry. Unlike the Employer Shared Responsibility requirements, which have the biggest impact on employers with low-paid, part-time workforces, the excise tax will hit hardest those industries that typically offer the richest benefits. Over half of large employers (500 or more employees) in transportation, communication, and utilities are estimated to hit the threshold in 2018, compared to just 18% of employers in the wholesale/retail industry. Location also plays a part, with large employers in the West far more likely to trigger the tax than large employers in the South (43% compared to 25%, respectively).

Keep in mind that these estimates assume that employers make no changes to their current plan. That’s not likely, considering that 30% of employers say they will do “whatever is necessary” to avoid the tax, and another 27% plan to take action to reduce the impact of the tax, although they recognize that it may not be possible to avoid it entirely. (The rest either believe it is unlikely that their plans will ever trigger the tax or do not plan to take action).

Many employers have begun taking action now to phase in changes that will keep them below the tax threshold in 2018 — to ensure a “soft landing.” One of the most important strategies, not surprisingly, is to implement a low-cost, high-deductible consumer-directed health plan, or to steer more employees into an existing plan (41% of large employers). Other popular cost-reducing measures include adding or expanding employee health management (or wellness) programs (31%), dropping higher-cost health plans (26%), and uncoupling medical and dental benefits (23%). A significant number of large employers — 15% — are considering moving to a private exchange as a way to avoid or minimize the impact of the excise tax by giving employees the option to choose lower-cost plans.