Supreme Court Set to Hear Latest ACA Case in November

You may have seen recent news reports that the US Supreme Court has scheduled oral arguments in the latest challenge to overturn the ACA. The case arose shortly after Congress cut the individual-mandate penalty for not having health coverage to $0 starting in 2019 as part of the tax reforms enacted in December 2017. Texas and 19 other Republican-led states sued, arguing the individual mandate is unconstitutional if it no longer imposes any tax.

A Texas judge sided with the GOP states. The court ruled that if the individual mandate's penalty is $0, the mandate is unconstitutional and since it can't be severed from the rest of the ACA, the entire ACA is invalid. The appeal by Democrat-led states will be heard by the Court on November 10, one week after the November election. A ruling isn't expected to be released until next year.

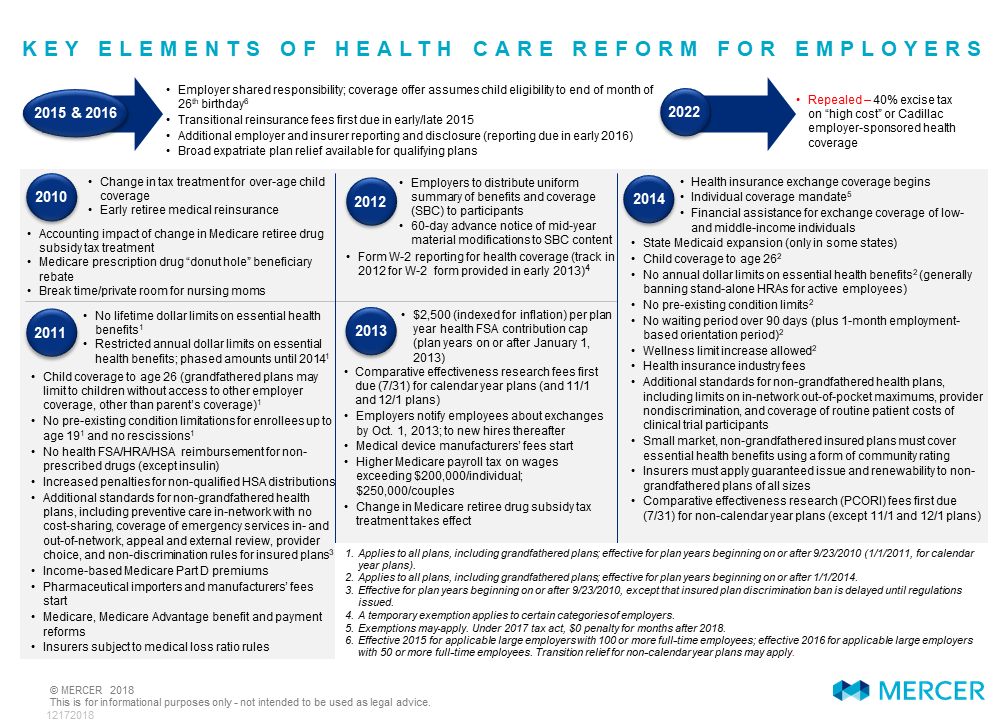

We’ve been through many twists and turns with the ACA since 2010. Although employers have had to become adept at changing course to comply with the ACA, a ruling unwinding the law would mean making some challenging decisions. Remember how daunting the list of employer requirements below looked in 2010? It would be no less daunting to determine which mandates you would voluntarily keep in place – for employee relations, staffing, or other reasons—and which you would drop. Clearly, there are elements most employers would be happy to see go. And there are others, like the hugely popular ban on pre-existing condition limitations, that would be harder for employers to reverse.

But for now, it’s business as usual. As employers work to finalize their 2021 benefits plans they must continue to comply with the ACA.