The FSA Going Through Some Changes

Employees can set aside tax-free funds to pay for child care and health care expenses through flexible spending accounts (FSAs). Over the years, FSAs have become a standard offering among large employers; they are relatively inexpensive to administer and can be a source of significant savings for employees. Mercer’s National Survey of Employer-Sponsored Health Plans 2014 found that 88% of employers with 500 or more employees offer a health care FSA and 85% offer a child care FSA.

Under the ACA, beginning in 2013 a new annual contribution limit of $2,500 was imposed on health care FSAs. There had been no regulated limitations to FSA contributions prior to this, though many employers opted to cap individual contributions at $5,000 (they still have the option of capping contributions below $2,500). Not surprisingly, the average annual contribution fell in the year the new limit took effect, from $1,484 in 2012 to $1,349 in 2013. However, it fell again in 2014, to $1,292. The growth in offerings of HSA-eligible consumer-directed health plans may also be having an impact on the amount of money employees choose to shelter in an FSA. An FSA that is offered alongside an HSA is deemed a “limited-purpose FSA,” and fewer types of expenses qualify — generally only dental, vision, or post-deductible expenses.

Child care FSAs were not affected by the ACA. The maximum allowable contribution remained $5,000, and the average contribution amount in 2014 was $3,233, similar to 2013’s average of $3,252. However, in a fact sheet released by the White House in conjunction with President Obama’s recent State of the Union address, the President proposed doing away with the child care FSA entirely, citing overlap with the child care tax credit and the fact that lower-income employees who don’t pay much tax don’t stand to save much from using an FSA. (You can read an analysis of the proposal in this article in Forbes.)

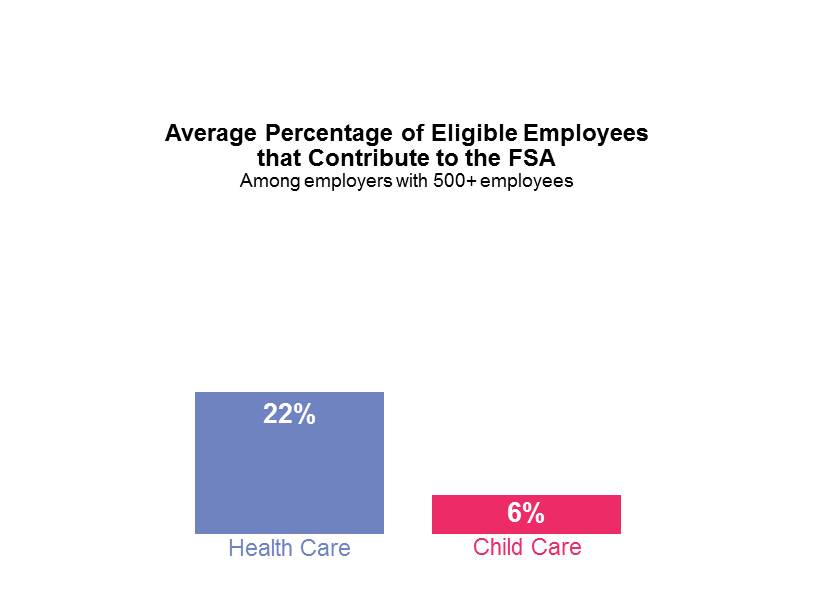

How much will employees miss the child care FSA, if it goes away? Take-up rates for both accounts are generally modest, with 22% of eligible employees participating in a health FSA and 6% in a child care FSA. By law, the funds in the account are subject to a “use it or lose it” clause, which can be off-putting to employees who don’t feel comfortable predicting their annual health care or child care expenses. Still, all of the employers in Mercer’s survey that were included on Fortune’s Best Places to Work list for 2014 offer both accounts.

Employers report that an average of 4% of their employees’ contributions to health care FSAs and 2% of contributions to child care FSAs were forfeited in 2013. Beginning in 2014, but expected to be more widely adopted in 2015, employers can now allow employees to carry over $500 in unused health FSA funds to the following year. Child care FSAs are not eligible for the carryover provision, and health care FSAs cannot have both a carryover and a grace period option. (Employers are not obligated to offer either extension.) While employees who forfeit a small amount would still most likely come out ahead, employers can help by sending a reminder to FSA participants at the end of the year, and again as the end of the two-and-a-half-month grace period approaches.