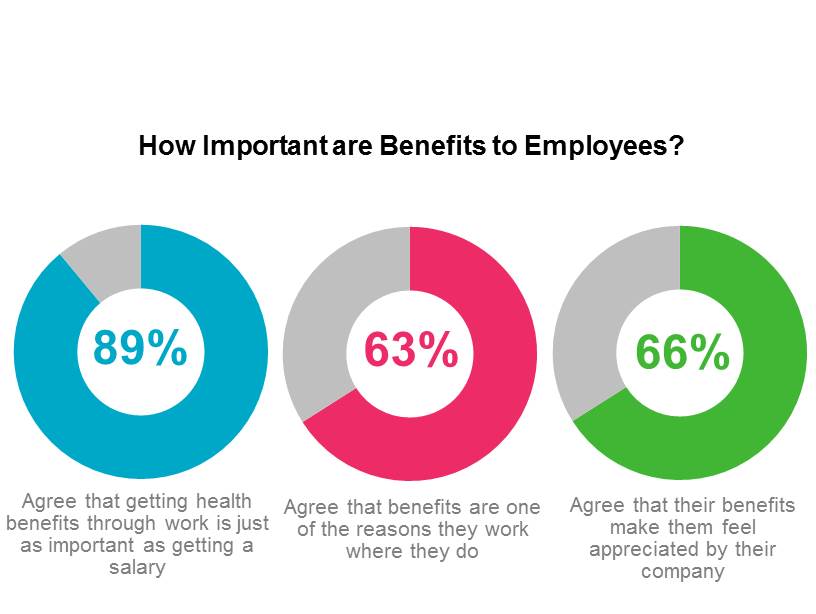

Think Employees Don't Appreciate Their Benefits? Think Again

Benefits matter. Findings from Mercer’s Inside Employees Minds™ Survey of 3,000 US workers show that 89%* of employees agree that getting health benefits through work is just as important to them as getting a salary. Base pay is, predictably, the most important factor for employees when considering compensation packages, but benefits also emerge as a vital component in recruitment: 63% of employees agree that benefits are one of the reasons they work where they do. They’re also essential in retaining employees, with 66% agreeing that their benefits make them feel appreciated by their company.

As the workforce is changing and evolving, benefit strategies need to follow suit. Employees seek increased flexibility; 58% of employees agree that they would like to reduce the value of some benefits they receive and increase the value of others. This trend is even more prevalent among the Millennial Generation, which now accounts for a quarter of the nation’s population(1). Having grown up in an environment where everything from your iPhone cover to your Instagram profiles to your Netflix lineup is unique and customizable, it’s no surprise that the desire for benefits flexibility increases to 70% among 18-34 year olds. Consumer-directed health plans with employee-controlled health savings accounts paired with a robust selection of voluntary benefits are one way to offer increased flexibility and added control by the consumer to decide where and how they spend their health care dollars.

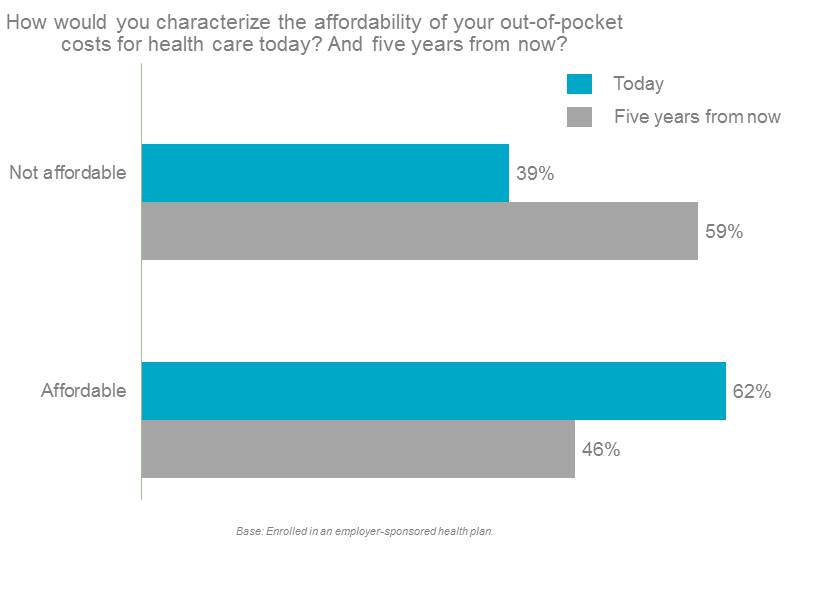

But while employees value their benefits and want additional flexibility in their options, they also recognize that health care costs are increasing and are concerned about the financial impact this trend will have on them. Fewer than two-thirds of employees (62%) characterize their current out-of-pocket costs as affordable, and when asked to look ahead five years, only 42% think their health care benefits will be affordable.

Not surprisingly, out-of-pocket costs are a bigger issue among employees with lower household incomes. Among of employees with reported household income below $75,000, 56% agree out-of-pocket costs are affordable today, compared to 73% of employees with household income above $100,000, and the disparity is even wider when they think ahead (34% and 54%, respectively, believe out-of-pocket costs will be affordable in five years). As employers shift more responsibility for health care decision-making to employees, it’s important to also provide the resources that lower-paid employees in particular may need. Financial wellness programs and health care decision-support tools can help guide employees along the path to consumerism.

Employees clearly recognize the value of the health benefits provided by their employer. Employers can, in turn, reinforce and enhance that value by adding flexibility to address the varied needs of their population – and providing the resources employees need to make that flexibility work for them and their families.

*Base: Enrolled in an employer-sponsored health plan.

1 https://www.census.gov/newsroom/press-releases/2015/cb15-113.html