Time to Revisit Your ACA Affordability Strategy?

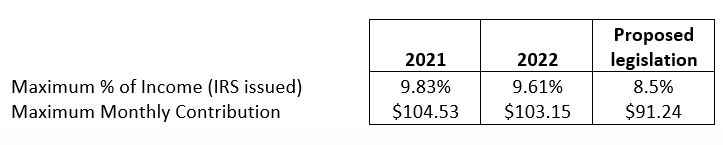

There are a few reasons to revisit your ACA affordability strategy now. First is the proposed legislation that will lower the ACA’s employer shared-responsibility benchmark for determining the affordability of employer-sponsored health care coverage to 8.5% of employee household income, from the 2022 9.61%. For employers using the Federal Poverty Line (FPL) safe harbor, monthly contributions for self-only coverage can be no more than $103.15 in 2022. If the change were implemented for 2022, the FPL safe harbor contribution would decrease to $91.24.

There may be are other factors to consider as well. If you’re contemplating offering a financial incentive or adding a surcharge to health plan premiums to encourage vaccinations, you would have to count that amount in the affordability calculation. In addition, state actions to raise the minimum wage complicate finding the right balance between pay and benefits, especially for employers in industries that rely on lower-paid, hourly workers.

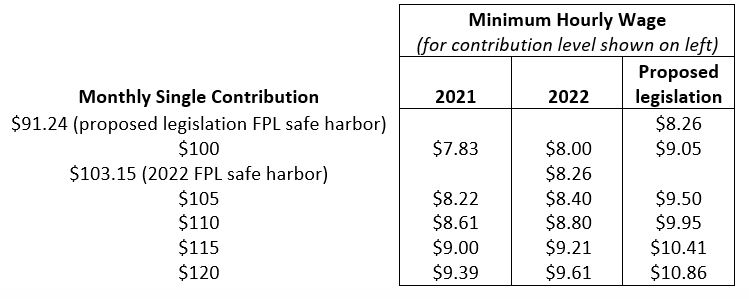

Given all this, it may be time to reevaluate your strategy for setting affordable contributions under ACA rules, especially if, like most employers, you’ve been using the FPL Safe Harbor up until now. While it offers the significant advantage of allowing the contribution to be prospectively determined, other methods may allow for a higher employee contribution. For example, employers paying greater than $8.25 per hour could satisfy an affordability safe harbor with a monthly contribution that is greater than the $103.15 FPL safe harbor. We show how in the descriptions below.

First, here’s another thought for your consideration. Many employers feel compelled to fit contributions within one of the safe harbors. However, they are not obligated to offer affordable coverage, though they may be subject to penalties for not doing so. Since the early days of the ACA, some employers have been content to have employees opt out of the employer plan and look to the exchanges for more affordable coverage, concluding that the 4980(H)(b) assessment (projected to be $4,120 in 2022) would likely be less than the cost of twelve months of medical coverage for a typical employee. In particular, employers planning to implement a vaccine-related surcharge or incentive might view employee contributions outside of the affordability safe harbors as an acceptable trade-off.

Know your Safe Harbors

To assist with a review of options, here are brief descriptions of the safe harbor methods of determining affordable contributions.

First, to recap the requirement: Employers with 50 or more full-time employees are subject to the ACA’s Employer Shared Responsibility rules, also known as the “Employer Mandate” or the “30 Hour Rule”. For an employer that offers medical coverage to at least 95% of its full-time employees working 30 or more hours, the employer may still owe an annual assessment (projected to be $4,120 in 2022) for any full-time employee that is not offered an affordable plan option and enrolls in public exchange coverage with an income-based premium tax credit. Employer-provided coverage is considered affordable if the contribution for self-only coverage does not exceed 9.61% (for 2022) of that employee’s household income or if the contribution meets one of the safe harbors below.

Federal Poverty Line. Each year, the IRS issues an affordability threshold as a percentage of the FPL. For 2022, the percentage issued was 9.61%. Thus, contributions lower than 9.61% of the FPL, converted monthly, is deemed to be “affordable” coverage by the IRS. For 2022, this monthly contribution amount is $103.15. The FPL Safe Harbor is the most commonly used method for determining affordability, mostly for its ability to be prospectively determined.

Rate of Pay. The Rate of Pay Safe Harbor allows employers to use hourly wage rates and monthly salaries to establish affordability. It uses the same 9.61% affordability threshold as the FPL method. For salaried employees, if contributions are less than 9.61% of their monthly salary (based on their rate of pay at coverage period start and no salary reductions occur), then coverage is deemed affordable. For hourly employees, employers are allowed to use an assumed 130 hours worked per month. So, if contributions are less than 9.61% percent of the hourly rate multiplied by 130, then coverage is deemed affordable.

This method allows a higher employee contribution than the FPL safe harbor. For example, employers could charge a contribution of $120/month in 2022 if all employees are paid an hourly rate of $9.61 or higher. But more administrative considerations are warranted. Changes in pay during a month can also impact the validity of this method.

W-2 method. The W-2 Safe Harbor method is determined using Box 1 on an employee’s current year W-2 to determine affordability. For 2022, if employee contributions are lower than 9.61% of the Box 1 amount, then coverage can be deemed affordable. However, recall Box 1 does not include pre-tax contributions (ex: 401k, HSA, etc.), which will reduce the maximum affordable amount. Additionally, this cannot be determined until the year is over. For this reason, employers with many part-time employees, a large hourly workforce, or employees who experience fluctuations in pay may find this method undesirable.

The consequences for not offering affordable coverage vary based on the individual situation. The IRS penalties are issued on a monthly basis and per employee receiving an income-based premium tax credit. This potential severity merits extra caution in setting employee contributions. Each safe harbor method produces a different contribution affordability amount. It would be wise to weigh the complexities of the each method and the administrative burden when establishing final employee contributions for 2022 and beyond.