What's Different About a Full Replacement CDHP?

Health reform has accelerated employer adoption of consumer-directed health plans (CDHPs). More than a third of all large US employers (500 or more employees) — and nearly two-thirds of jumbo employers (20,000 or more employees) — offered an account-based CDHP in 2013. However, because CDHPs are usually offered as an option alongside PPO or HMO medical plan choices, enrollment remains relatively low, at 18% of all covered employees.

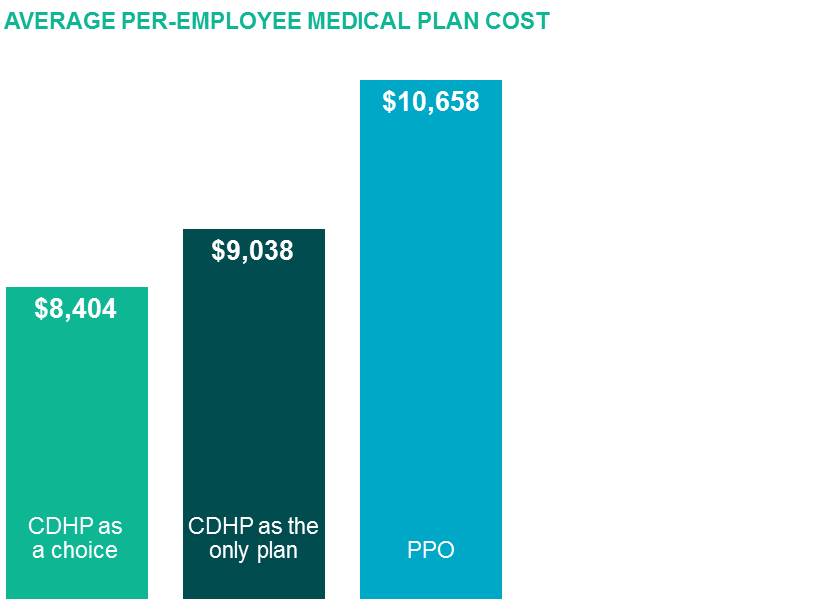

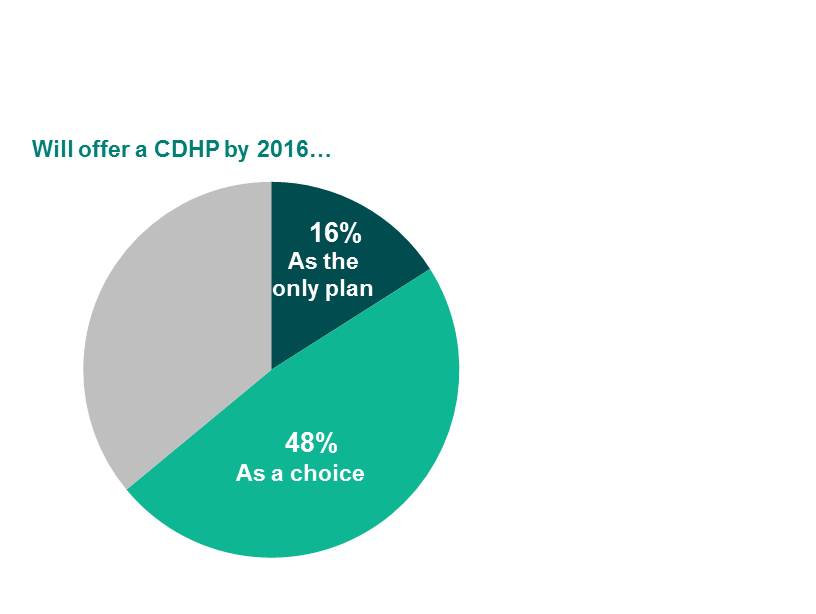

CDHP coverage costs 15% less, on average, than PPO coverage, and 18% less than HMO coverage, but limited enrollment translates to limited savings. Some employers have already taken the step of offering a CDHP as the only plan, and more are considering it. While just 6% of all large employers offered a full-replacement CDHP to employees at their largest worksite in 2013, 16% say they will do so by 2016, as shown in the chart above. That figure rises to 29% among the jumbo employers.

But do employers that offer CDHPs as a full replacement see the same level of savings as when the plan is offered as an option? And, in designing a full-replacement plan, do employers take into account the fact that the plan must now work for all employees, rather than the minority who typically select it? To find out, we analyzed data from Mercer’s National Survey of Employer-Sponsored Health Plans to compare HSA-eligible CDHPs offered as a full-replacement strategy to those offered alongside PPOs or HMOs.

Full-replacement CDHPs tend to have richer plan designs than CDHPs offered as an option. When a CDHP is the only plan, employers are more likely to make a contribution to a health savings account (77%, compared to 70% of those offering a CDHP alongside a PPO or HMO), and the contribution amount is higher (the median employer account contribution for a family is $200 higher when the HSA plan is offered as a full replacement). Deductibles are about the same, but prescription drug benefits are more often covered at a separate, higher benefit level (67% of full-replacement plans, compared to 57% of plans offered as a choice). And employers with full-replacement plans go to greater lengths to explain the plan to employees and help them to use it (24% say their communication efforts are “very extensive,” compared to 15% of employers with optional CDHPs).

But employers offering CDHPs as a choice require lower contributions. While full-replacement plan design is richer, without the need to entice employers to select the CDHP over other plan types, employee contributions are higher. The average employee contribution requirement for full-replacement HSA-eligible plans are $82 and $268, respectively, for employee-only and family coverage, compared to $64 and $244 for plans offered as an option.

Many assume you lose most of the savings with full-replacement…not true! Some critics of the CDHP model have argued that CDHP savings are due at least in part to risk selection — younger, healthier people opting to enroll in the CDHP. However, as shown below, the average per-employee cost for a HSA-eligible CDHP offered as a full replacement — in which risk selection is not a factor — is only 7.5% higher than for an optional CDHP. And it’s still 15% less expensive than the average PPO plan.