Actuarial solutions

Our core actuarial strategies

We want to help you design the right mix of retirement plan strategies and also recognize they may go far beyond the basic maintenance of a retirement plan.

Our defined benefit actuarial strategies include:

- Integrating our Pension Strategy and Solutions Group to help you manage the risks inherent in your defined benefit plan.

- Providing quality services without compromise, as demonstrated by our Statement of Standards for Attestation Engagements (SSAE) 18 certification for our actuarial valuation work and processes.

- Maintaining a robust retirement plan and total compensation benchmarking capabilities.

Pursuing innovative ideas to match the characteristics of your plan to your company’s objectives.

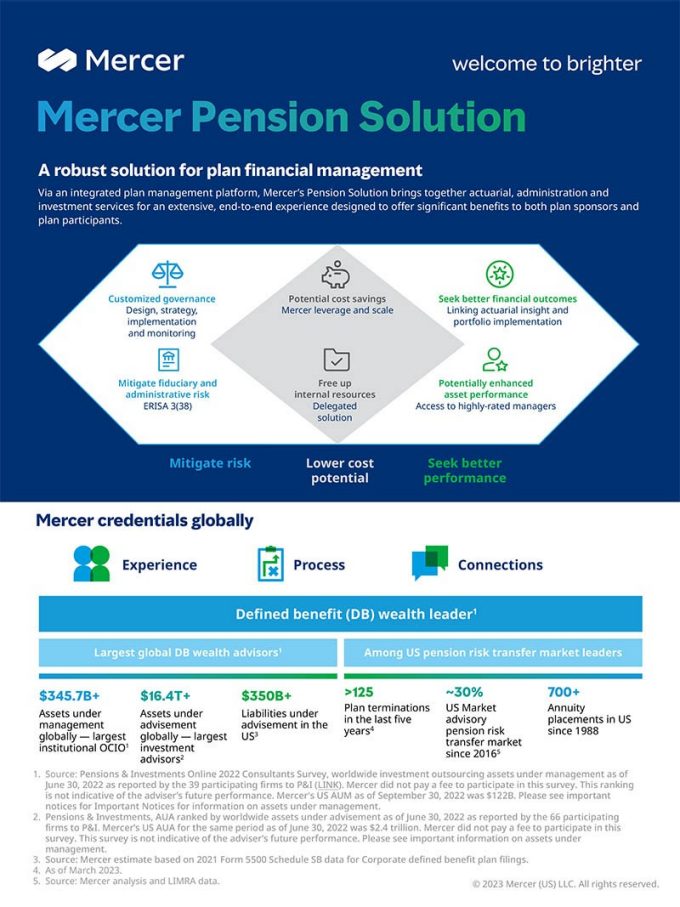

Mercer pension solution

Via an integrated plan management platform, Mercer’s Pension Solution brings together actuarial, administration and investment services for an extensive, end-to-end experience designed to offer significant potential benefits to both plan sponsors and plan participants.

Client teams can include specialists in:

- Actuarial solutions

- Defined benefits strategy

- Portfolio implementation

- Portfolio monitoring

- Tactical outsourcing

Extensive actuarial consulting services

Our credentialed actuaries and supporting actuarial analysts can guide you through your defined benefit pension plan’s design, implementation, and maintenance.

Our actuarial consulting services include:

- Annual valuation services

- Funded status monitoring

- Retirement plan financial management

- Budget forecasting

- Compliance requirements

- Retirement plan design

- Benchmarking and retirement adequacy

- Merger and acquisition support

- Plan termination

- Integrated retirement plan strategy support

Before you access this page, please read and accept the terms and legal notices below. You are about to enter a page intended for sophisticated, institutional investors based in the USA only.

This content is provided for informational purposes only. The information provided does not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities, or an offer, invitation or solicitation of any specific products or the investment management services of Mercer, or an offer or invitation to enter into any portfolio management mandate with Mercer.

Past performance is not an indication of future performance. If you are not able to accept these terms and conditions, please decline and do not proceed further. We reserve the right to suspend or withdraw access to any page(s) included on this website without notice at any time and Mercer accepts no liability if, for any reason, these pages are unavailable at any time or for any period.