Dental Benefits Could Take the Bite Out of the Excise Tax

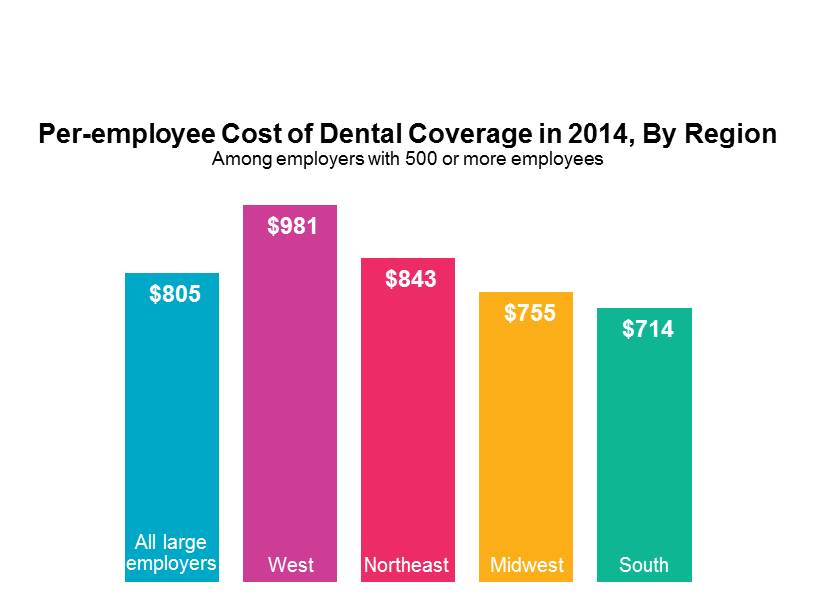

For as long as we’ve been conducting our National Survey of Employer-Sponsored Health Plans — nearly 30 years now — employers in the Western US have spent more on dental benefits than employers anywhere else in the country, even though they are not the top spenders on medical benefits. In 2014, the average cost of dental coverage was $805 per employee. Regionally, average cost was highest in the West at $981 per employee and lowest in the South at $714.

I’ve noticed the discrepancy every year and wondered about it. Do dentists charge more in the West? Is utilization that much higher? The answer hit home at a family reunion. Two of my siblings live on the West Coast, and two of us live in the East. One year, both of the West Coast siblings and one of their spouses turned up wearing braces, much to the amusement of my East Coast sibling and me. Of course the joke was on us the following year, when our sibs’ smiles outshone ours in the group photo.

Employers in the West offer more generous dental benefits. They are more likely to coverage adult orthodontia (51%, compared to 34% in the Northeast) and implants (66%, compared to 59% in the Northeast). Fewer require a deductible for restorative care. And while the benefits are richer, the employee contribution requirements are lower. On average, employers in the West require workers to pay 36% of the premium for employee-only coverage, compared to 50% of premium nationwide — and 54% in the Northeast.

What does this have to do with the ACA’s 40% excise tax on high-cost plans? Normally when we write about the excise tax, we’re discussing ways for employers to lower the cost of the medical plan to avoid hitting the cost threshold. Here’s a thought for employers in my home territory — the Northeast — that may be looking for ways to maintain a more generous benefit package while still avoiding the excise tax. Dental benefits are well utilized and highly valued — but the cost of freestanding dental plan doesn’t count toward the excise tax cost threshold. If you have to cut back on the medical benefit, considering sweetening the dental benefit. If you use the typical dental benefit in the West as your yardstick, you may see there’s room for improvement in yours.