Survey: Health Benefit Cost Growth Spiked in 2021, Outlook is Uncertain

Growth in spending on prescription drugs continued to exceed overall medical cost growth, rising 7.4% in 2021 among large employers (those with 500 or more employees). This increase was driven by another jump in spending on specialty drugs, of 11.1%.

Employee cost-shifting comes to a halt in 2021

When health benefit cost growth accelerates, employers typically ratchet up cost management efforts to keep increases at sustainable levels. However, one common cost management tool – where employers shift a larger share of the cost of health services to plan members – seems to be off the table for many employers.

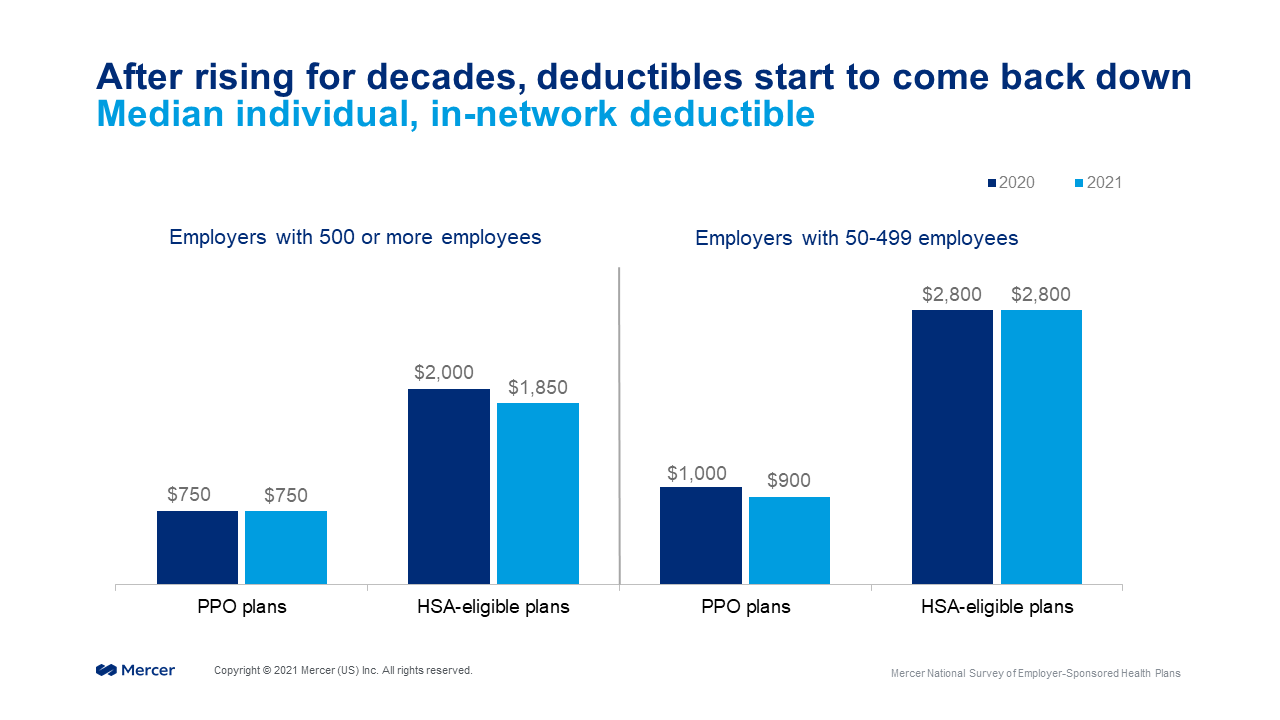

In fact, concerns about health care affordability for lower-wage workers, along with the need to retain and attract employees in a competitive labor market, have resulted in an unexpected reversal in some health plan cost-sharing trends. Most employers not only held off on raising deductibles and other cost-sharing provisions, but some even made changes to reduce employees’ out-of-pocket spending for health services. Among small employers (50-499 employees), the median deductible for individual coverage in a PPO dropped from $1,000 to $900 in 2021. Among large employers, the median individual deductible in an HSA-eligible plan dropped from $2,000 to $1,850 in 2021.

Managing health benefit cost without shifting cost to employees

Looking ahead to 2022, the majority of plan sponsors (60%) say they will not make plan changes of any type to reduce their expected cost increase. This is largely due to employers focusing their attention on enhancing benefits to support employees and stay competitive in a tight labor market, but the sharp cost increase suggests a need to prioritize how they will manage costs.

The tough challenge of solving for both health care cost and health care affordability means maximizing value and accepting the disruption it may bring. Over the next few years, health program strategies will increasingly focus on these three key components of value: Quality, delivery, and personalization.

Steer to quality. During the health system disruption of the past two years, employers have been less able to pursue quality initiatives that seek to drive members to high-performing providers, such as centers of excellence and accountable care organizations (ACOs). Employers need to resume these efforts, but with a new emphasis on convenience. Value starts with quality providers that achieve good outcomes, but convenience must be part of the equation, along with affinity. People want to get their care through the channels they are most comfortable with, and that’s not always a doctor’s office. It might be a pharmacy, a retail establishment, or online.

Broaden care delivery modalities. Convenience is a major advantage of virtual health care, which can also serve to improve access without adding cost. Employees are more open to virtual care than ever before. With in-person health care severely limited during the worst of the pandemic, telemedicine clearly got a boost: utilization rates had stagnated at 9% or less among large employers for many years; it jumped to 15% in 2020 and has held at 12% during the first half of 2021.

However, virtual care also encompasses a wide range of digital health solutions that don’t rely solely on real-time interactions with a live health care professional. Targeted health solutions that address specific health conditions such as diabetes or musculoskeletal are now offered by 25% of all large employers and another 20% are considering adding them. Such programs can save money for both the employer and the employee by substituting at-home care – for example, online physical therapy – for in-person visits. A virtual Primary Care Physician (PCP) network or service is offered by 16% of large employers, with 10% considering. And 28% of all large employers (and 43% of those with 20,000 or more employees) offer a virtual behavioral health care network.

Personalize benefits to optimize value for individuals. Employers can maximize value by adding variety to their offerings and allowing employees to personalize their benefit packages to be most relevant to them. For example, while only a small portion of the workforce might use a fertility program, it could have a big impact in their lives. The same is true of online resources for parents of children with autism, or benefits for treatment of gender dysphoria.

In today’s environment of varied working situations, employers see this type of personalization as a way to “even out” the benefits available across onsite, remote, and hybrid workers. Nearly one in five employers that expect more employees to work remotely (18%) say that they have added voluntary benefits specifically for this reason. The prevalence of pet insurance, legal benefits, student loan repayment and ID theft programs all rose in 2021.

These are only a few of the findings of Mercer’s 2021 National Survey of Employer-Sponsored Health Plans. Watch this space for further discussion of the results and their implication for employers – and speak with your favorite Mercer consultant about benchmark data.

Nationally, 40% of all covered employees enrolled in a high-deductible consumer-directed plan in 2021, up from 38% in 2020. However, most large employers that offer a CDHP at their largest worksite (86%) also offer employees another medical plan choice with a lower deductible.

Additionally, large employers did not increase employee premium contributions significantly in 2021. The average monthly paycheck deduction rose by just $7 for employee-only coverage (from $160 to $167) and by just $12 for family coverage (from $590 to $602) in PPO plans, the most common type of medical coverage offered.

Prioritizing employee support

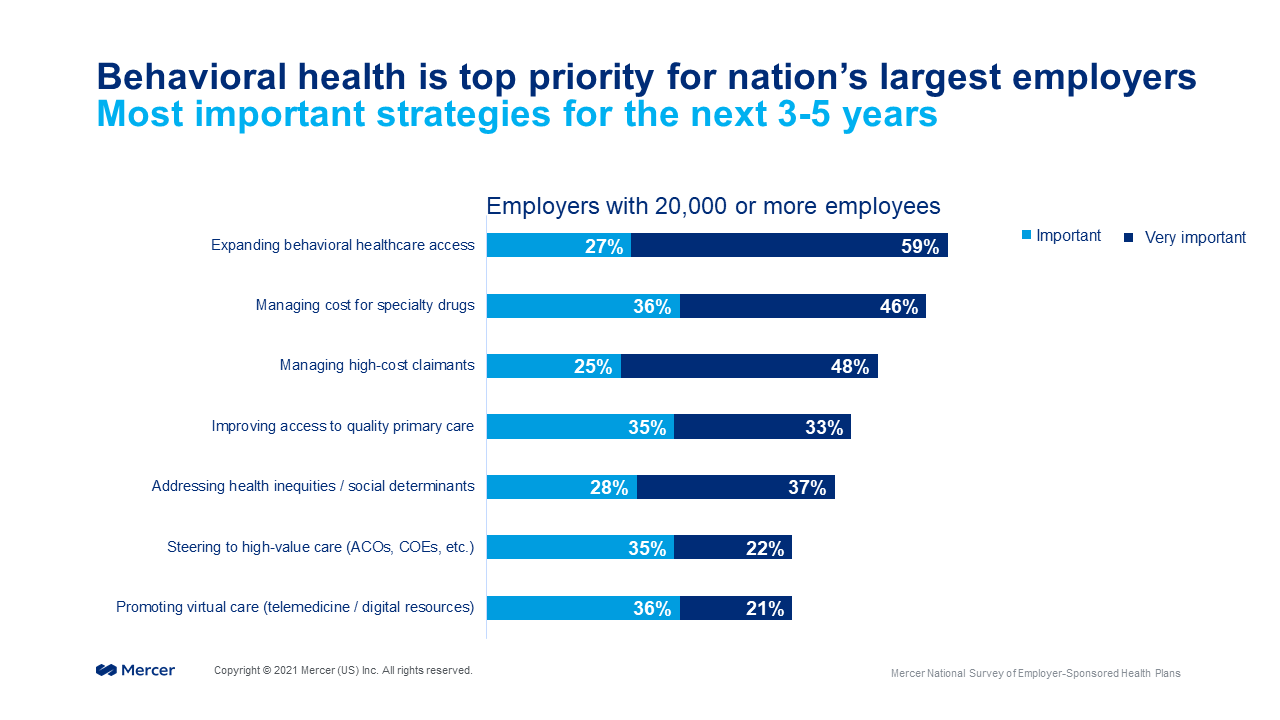

Benefit priorities have shifted in response to the pandemic’s impact on the workforce and evolving benefits landscape. Many employers view supporting the mental, emotional and behavioral health of employees as a business imperative. Based on the survey results, adding or expanding programs to increase access to behavioral healthcare is a top-three priority for all large employers (74% rated it important or very important) – and it is the number one priority for employers with 20,000 or more employees (86% rated it important or very important).

In today’s extremely tight labor market, generous health benefits can help tip the scales in attracting and retaining staff. Beyond that, in the wake of the pandemic many employers committed to help end health disparities, and ensuring care is affordable for their full workforce is an important part of that.

The survey found that nearly half of all large employers – and about two-thirds of those with 20,000 employees – say that addressing health equity and the social determinants of health will be an important priority over the next 3-5 years.

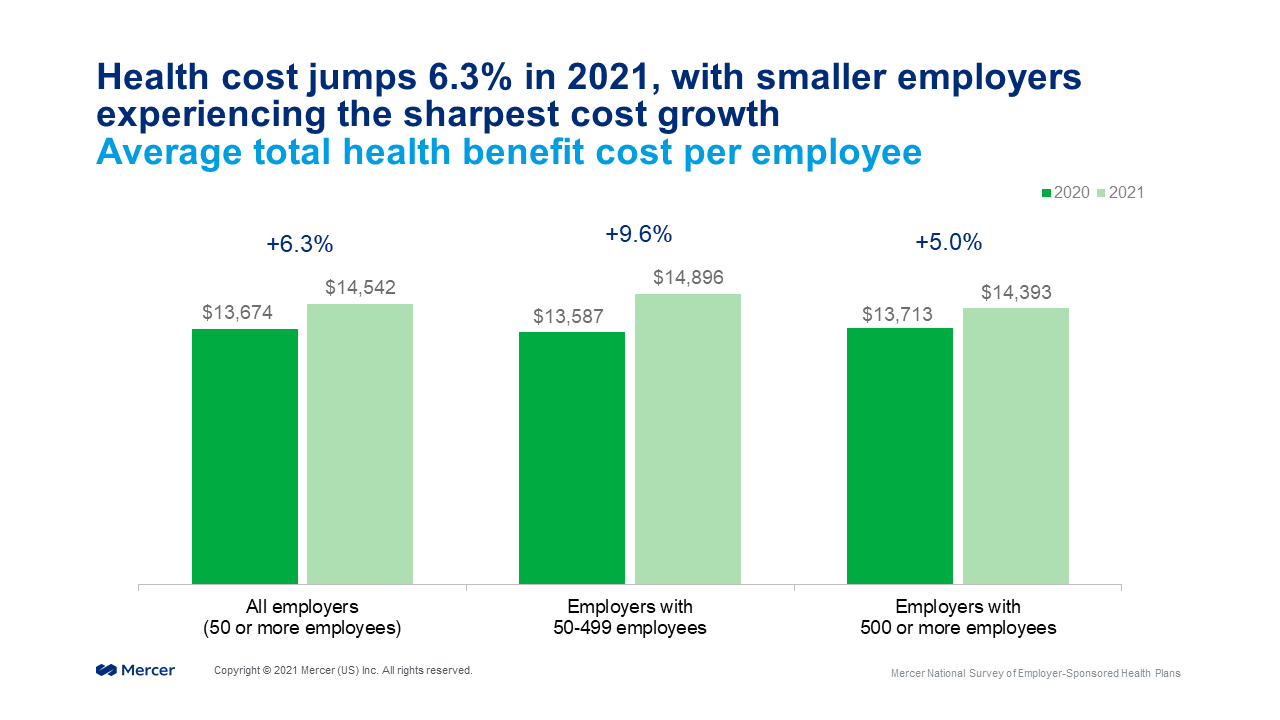

- Average costs for employer-sponsored health insurance rose 6.3% in 2021 to reach $14,542 per employee, following last year’s increase of just 3.4%

- Employers halted cost-management tactics that shift cost to employees, focusing instead on improving health care affordability and access to mental health care

- In a tight labor market, employers can optimize health benefit value with quality initiatives, virtual care and personalization of benefits

The average per-employee cost of employer-sponsored health insurance jumped 6.3% in 2021 as employees and their families resumed care after avoiding it last year due to the pandemic, according to Mercer’s 2021 National Survey of Employer-Sponsored Health Plans. More than 1,700 organizations participated in the 2021 survey and results are weighted to represent all US health plan sponsors with 50 or more employees.

With the highest annual increase since 2010, health benefit cost outpaced growth in inflation and workers’ earnings through September, raising the question of whether employers are seeing a temporary correction to the cost trend (following last year’s increase of just 3.4%) , or the start of a new period of higher cost growth.

Employers are projecting a cost increase of 4.4% on average for 2022, which is more in line with prior increases. However, while the sharper increase this year may simply be a result of people getting back to care, other factors could result in ongoing cost growth acceleration. These include (in addition to ongoing “catch-up” care) new claims for long COVID, extremely high-cost genetic and cellular drug therapies, and possible inflation in healthcare prices.

Cost growth was sharper among smaller employers (50-499 employees), at 9.6%, while larger employers reported average cost growth of 5.0%. Smaller employers are more likely to offer fully insured health plans, suggesting that insurance carriers expected significantly higher cost in 2021 relative to 2020.